Search News

Click chart for market data

Click chart for market data

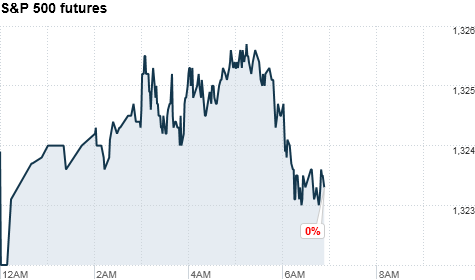

NEW YORK (CNNMoney) -- U.S. stocks were poised to open slightly lower Thursday, after a weekly report on jobless claims that was a bit higher than expected.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were narrowly mixed ahead of the opening bell. Futures measure current index values against perceived future performance.

Dick Del Bello, senior partner with Conifer Group, a hedge fund service provider, said investors are relatively optimistic about the job market, but frustrated with its slow recovery.

"I think the anticipation is that the job market is improving," he said. "It's slow, but it's improving. I think everyone would like to see it happen faster, but it's not going to happen."

But Del Bello said the markets were being held down by "overhang in Europe" about debt issues, as well as concerns over the post-earthquake nuclear disaster in Japan.

U.S. stocks ended Wednesday with solid gains, after two upbeat reports on job growth. One report from outplacement consulting firm Challenger, Gray & Christmas said private employers announced fewer planned job cuts in March -- even as government layoffs mounted.

A second report, from payroll processor ADP, showed private sector employment rose by 201,000 in March. Investors view the ADP report as a guide for what's coming in Friday's employment report from the Labor Department.

A CNNMoney survey of 18 economists forecast an 180,000 jump in payrolls. They also expect the unemployment rate to hold steady at 8.9%.

So far this week, investors have shrugged off ongoing global concerns in the Middle East, Libya and Japan.

In Europe, shares were mixed as investors await the results of bank stress tests in Ireland. On Thursday, Anglo Irish Bank announced a $25.2 billion loss, with its stress test results due later in the day.

Treasury Secretary Tim Geithner is in China for a meeting of G-20 finance ministers in Nanjing. In prepared remarks, Geithner said developing nations need flexible exchange rates to help absorb economic shocks, an apparent response to criticism of U.S. monetary policy made a day earlier by a Chinese economist.

Economy: The government's weekly jobless claims report showed a decline of 6,000 claims to 388,000 in the week ended March 26, which was slightly more than expected.

Economists had expected new claims to total 383,000 last week, according to a consensus of forecasts compiled by Briefing.com.

The Chicago-area purchasing managers' index for March is due at 9:45 a.m. ET. Additionally, the Commerce Department's February factory orders report is on tap for 10 a.m. ET.

Companies: Warren Buffett's heir apparent, David Sokol, quit Berkshire Hathaway (BRKA, Fortune 500). In a press release Wednesday, Buffett said the resignation was a "total surprise," but he also revealed that Sokol had purchased shares of Lubrizol (LZ, Fortune 500) before pushing him to buy the company in March for $9.7 billion.

Sokol told CNBC on Thursday that working for his "mentor" Buffett was "one of the best experiences of my life," but that he "wanted to invest our family money and build a mini-Berkshire, if you will."

"I'd like to do what [Buffett] did in 1965: invest my own money," he said.

He also said that he told Buffett he owned Lubrizol shares prior to the Berkshire merger, and insisted there was no conflict of interest, since he had no control of the deal.

"I don't believe I did anything wrong," he said.

World markets: European stocks were mixed in midday trading. Britain's FTSE 100 and the DAX in Germany were little changed, while France's CAC 40 slipped 0.4%.

Asian markets ended mixed. The Shanghai Composite fell 0.9%, while the Hang Seng in Hong Kong ticked up 0.3% and Japan's Nikkei added nearly 0.5%.

Currencies and commodities: The dollar fell against the euro and the Japanese yen but was flat versus the British pound.

Oil for May delivery gained $1.03 to $105.30 a barrel.

Gold futures for June delivery rose $8.10 to $1,433 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged slightly higher, pushing the yield down to 3.44% from 3.45% late Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |