Click on chart for more premarket data.

Click on chart for more premarket data.

NEW YORK�(CNNMoney) -- U.S. stocks were headed for a weak open Tuesday, after Cisco announced impending job cuts, and Japanese officials raised the threat level at the Fukushima nuclear plant to the same as Chernobyl.

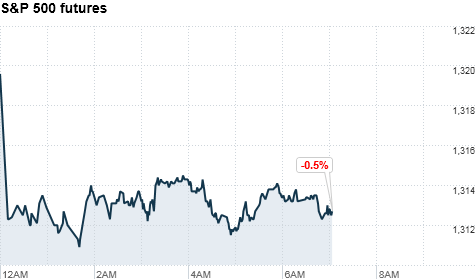

Dow Jones industrial average (INDU) futures ticked down about 0.25% ahead of the opening bell, while S&P 500 (SPX) and Nasdaq (COMP) futures were about 0.5% lower. Futures measure current index values against perceived future performance.

Early Tuesday, the Japanese government bumped up the accident at the Fukushima Daiichi nuclear power plant to a level that put it on par with the Chernobyl disaster in 1986.

The plant was damaged when it was hit by a tsunami that followed northern Japan's massive March 11 earthquake. Since then, more than 400 aftershocks of a 6.0 magnitude or greater have struck the country, according to Japan's Meteorological Agency.

"When you look at Japan today, they're not only recovering from the earthquake, but also from a major nuclear crisis -- and that raises concerns that we may have supply shortages coming out of there," said James Shelton, chief investment officer of Kanaly Trust in Houston, which manages $1.7 billion.

Asian markets sold off following the news, starting with the Hang Seng in Hong Kong losing 1.3% and Japan's Nikkei tumbling 1.7%. Shanghai Composite edged lower 0.1%.

The S&P 500 fell as much as 5% in the days following the first quake, but has since recovered those losses.

On Monday, U.S. stocks gave up an early advance and closed little changed, as investors look toward corporate reports due throughout the week.

Companies: Cisco Systems announced that it was taking a restructuring charge of $300 million, as it prepared to reduce its staff by 550 workers. Cisco (CSCO, Fortune 500) shares dipped 1% on the news.

Alcoa (AA, Fortune 500) kicked off earnings seasons with a first-quarter profit that beat estimates, but shares fell 3.3% in premarket trading, because the aluminum maker missed forecasts on revenue.

Budget battles: Early Tuesday, lawmakers finally revealed the specific spending cuts that make up the budget plan signed last week.

The 2011 budget cuts will slash $40 billion -- cutting back on a wide range of programs and services including high-speed rail, emergency first responders and the National Endowment for the Arts.

In the afternoon, the Treasury Department will release its latest tally on the federal deficit. Economists expect the report to show the deficit fell much deeper into the red, falling $189 billion in March alone -- more than twice the $65.4 billion in debt the government racked up in March last year.

Economy: The Commerce Department released data on the U.S. trade balance for February, showing that the deficit narrowed to $45.8 billion, the gap was slightly more than expected.

Economists surveyed by Briefing.com expected the report to show the trade deficit narrowed slightly to $45.7 billion, down from $46.3 billion in January.

On Sunday, China reported a small surplus for March, but reveled a larger than $1 billion trade deficit for the first quarter. The U.S. data lags a month behind the Chinese report.

World markets: European stocks fell in morning trading. Britain's FTSE 100, the DAX in Germany and France's CAC 40 all slid more than 1%.

Currencies and commodities: The dollar rose against the British pound, but fell against the euro and the Japanese yen.

Oil for May delivery fell 29 cents to $109.63 a barrel.

Gold futures for June delivery fell $1.50 to $1,466.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.53% from 3.57% late Monday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |