Search News

Click on chart to track markets

Click on chart to track markets

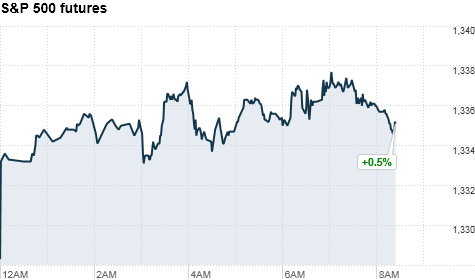

NEW YORK (CNNMoney) -- Stocks were headed for another day of gains Thursday, with tech stocks primed for a significant advance after Apple reported strong quarterly earnings.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all higher ahead of the opening bell. In particular, Nasdaq futures rose more than 1%. Futures measure current index values against perceived future performance.

Late Wednesday, Apple (AAPL, Fortune 500) reported an 83% jump in sales and said profit nearly doubled from a year earlier. Shares rose 4% in premarket trading. (Apple doubles its profit)

Stocks surged on Wednesday, with the Dow rising nearly 200 points and the Nasdaq rising 2%, as Wall Street cheered solid earnings results out of the technology sector.

John Herrmann, senior macro strategist for State Street Bank in Boston, said that market activity is being driven by "an overall economy that's expanding, an international upswing in the global economy, small businesses starting, big businesses expanding, and banks that are lending again."

Companies: Industrial conglomerate and Dow component General Electric (GE, Fortune 500) said first-quarter earnings rose 48% to $3.4 billion on revenue of $38.4 billion. The company also raised its quarterly dividend by a penny to 14 cents.

The company has been under pressure lately, facing criticism about its 2010 taxes and role in the nuclear crisis following Japan's March 11 earthquake. GE designed all six nuclear reactors at Japan's Fukushima Daiichi nuclear power plant.

GE shares rose 2% in premarket trading.

Economy: The Labor Department announced that jobless claims totaled 403,000 last week, which was stronger than the forecast, but had little impact on stock futures.

Economists expected a drop to 390,000 from the prior week's revised figure of 416,000.

The Philadelphia Federal Reserve releases its April activity index at 10 a.m. ET. The index of industrial activity in the Philadelphia region is expected to drop to 33 from last month's 43.4.

World markets: European stocks rose in midday trading. Britain's FTSE 100 advanced 0.2%, the DAX in Germany rose 0.7% and France's CAC 40 gained 0.4%.

Asian markets ended higher. The Shanghai Composite rose 0.7%, the Hang Seng in Hong Kong added 1% and Japan's Nikkei advanced 0.8%.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Oil for June delivery added 26 cents to $111.71 a barrel.

Gold futures for June delivery broke another intraday trading record, rising to $1,509.50 an ounce in early trading, before backing down to $1,503.50.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.37% from 3.40% from late Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |