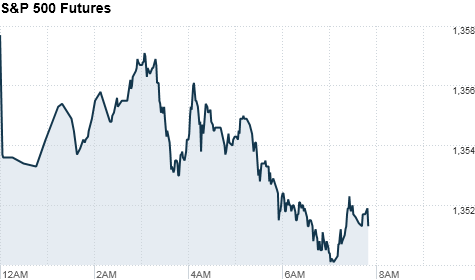

Click chart for more premarket data.

Click chart for more premarket data.

NEW YORK�(CNNMoney) -- U.S. stocks were set to open lower Tuesday, as investors shift focus back to the economy, and await auto sales and factory orders.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all down between 0.2% and 0.3% ahead of the opening bell. Futures measure current index values against perceived future performance.

On Monday, U.S. stocks finished slightly lower, as investors reversed from their initial positive reaction to news that Osama bin Laden had been killed. Traders and investors said it will take more to sustain a longer rally.

"Fundamentally, not much as has changed," said Zahid Siddique, Associate Portfolio Manager of Gabelli Equity Trust. "We still have all the macro issues, whether it is the Middle East, Europe, Japan."

Monday's losses ended a five-day winning streak for the S&P 500 and Dow.

April was the strongest month for stocks since December. In fact, stocks have been steadily marching higher since the start of the year. But risks still remain: the economy is far from out of the woods, and, while earnings have been strong, investors remain nervous about whether companies can sustain their growth.

The government's main jobs report for April is due out Friday, and investors will be paying close attention. Jobs remain one of the biggest -- if not the biggest -- drivers of the economic recovery. "It will be better but not that much higher to really move the needle," Siddique said.

Investors need to see a positive trend in the labor market, and they haven't seen that yet.

As the economic recovery in the U.S. battles consistently high unemployment and slowing growth, Federal Reserve chairman Ben Bernanke has maintained his position that interest rates will remain low for the foreseeable future -- despite growing concerns of inflation.

Meanwhile, emerging markets are showing concern about inflation: India announced that it raised its key lending rate from 6.75% to 7.25%.

Economy: The Commerce Department releases data on March factory orders at 10 a.m. ET, with economists polled by Briefing.com looking for a 2.5% rise, compared with February's 0.1% decline.

Investors will also get monthly auto sales figures from the major car makers starting around 11 a.m. ET.

Companies: Dow component Pfizer (PFE, Fortune 500) reported earnings per share that beat by a penny, but revenue was just in line with forecasts. The drugmaker reaffirmed its outlook, but investors were hoping for more. Shares fell about 2% in premarket trading.

Sears Holdings (SHLD, Fortune 500) issued a disappointing outlook late Monday. Shares fell nearly 8% in premarket trading.

Credit card processor MasterCard (MA, Fortune 500) reported earnings per share share of $4.29, up 24% from the same time a year ago. The company cited an 11.1% increase in transactions. Shares were up about 1.6% in premarket trade.

Media company CBS (CBS, Fortune 500) its quarterly reports after the opening bell.

World markets: European stocks were lower in afternoon trading. Britain's FTSE 100 slipped 0.1%, the DAX in Germany fell 0.7% and France's CAC 40 edged down 0.5%.

Asian markets also ended the session mixed. The Shanghai Composite rose 0.7%, while the Hang Seng in Hong Kong dipped 0.4%. Japan's Nikkei was closed for holiday.

Currencies and commodities: The dollar rallied against the euro and the British pound, but slipped against the Japanese yen.

Oil for June delivery fell $1.49 to $112.03 a barrel.

Gold futures for June delivery dropped $14 to $1543.10 an ounce.

Silver futures for May delivery were slid $2.50 to $43. 58 an ounce.

Bonds: Bond prices were up slightly. The price on the benchmark 10-year U.S. Treasury edged higher, pushing the yield down to 3.26% from 3.29% late Monday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |