The Economy: Why it feels even worse

In late October, CNN's Ali Velshi and Erica Fink looked at five key measures of the economy to see how bad it really was. Now, they look again at the CNN "Real Feel Economic Index" and find it's tougher still.

As you've heard us and others report, the U.S. economy, more so than other worldwide economies, is dependent on spending decisions made by consumers. Consumer behavior drives spending habits, spending habits drive corporate profitability, and corporate profitability drives the stock market.

Success in the stock market is one of those things that make Americans feel better about the economy, along with increases in wages (not happening) and increases in home prices (also not happening).

Typically, we measure economic strength or weakness using the GDP, or Gross Domestic Product, which is historically thought of as the broadest measure of economic activity.

But, while GDP may be a good measure of the whole economy (and it may not be, but that's another story), it doesn't reflect all the things that matter to you.

In the fall, we took a look at five measures of the economy that reflect how things really are out there, to see if your fears and concerns are justified. The measures we chose are those that we "touch" on a daily basis.

We looked at how the economy is affecting you, via jobs, personal income, personal savings, industrial production, and home prices.

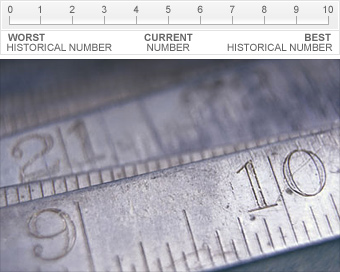

We charted them on a scale of 0-to-10: 0 being the worst that each of them has been since 1980; 10 being the best.

1980 was our starting point because experts agree that the economy before then was so different from what it is now that it would be like comparing apples and oranges.

Now, over a year into the recession, we're taking a look at it again.

We call it the CNN "Real Feel Economic Index."