Goldman Sachs: 7 power players

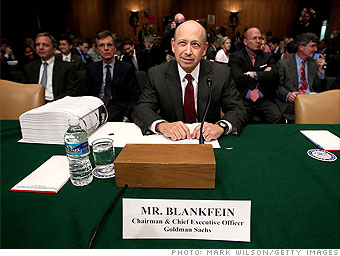

Lloyd Blankfein, Fabrice Tourre and 5 other Goldman Sachs managers appeared on Capitol Hill to defend the company's mortgage market moves.

"It was one of the worst days in my professional life."

That's how Blankfein describes April 16 -- the day the SEC brought fraud charges against Goldman Sachs and unleashed a firestorm around Wall Street's top investment bank.

Defiant since then, Blankfein insists that Goldman Sachs did not bet against its clients in a securities package tied to subprime mortgages. At his appearance before the Senate's Permanent Subcommittee on Investigations, he said the firm lost money -- to the tune of about $1.2 billion -- from the housing bust.

"We didn't have a massive short against the housing market, and we certainly did not bet against our clients. Rather, we believe that we managed our risk as our shareholders and our regulators would expect," Blankfein said in his opening statement.

Internal Goldman Sachs e-mails released by a Senate subcommittee over the weekend, however, describe what critics call the "big short."

"Of course we didn't dodge the mortgage mess," Blankfein told company executives in an e-mail dated Nov. 18, 2007. "We lost money, then made more than we lost because of shorts," he said, referring to trading bets that pay off when a bond drops in value.

NEXT: Fabrice Tourre