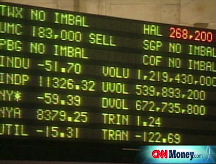

Dow gets 331-point boost

Wall Street cheers falling oil prices with one of the biggest gains of the year - helped along by Fed's rate decision and comments about inflation.

NEW YORK (CNNMoney.com) -- Stocks surged to one of the year's biggest gains Tuesday, as oil prices fell sharply and investors appeared to take solace in the Federal Reserve's assessment of the nation's economy.

The rally snapped a string of three straight losing sessions.

The Dow Jones industrial average (INDU) rose 2.9%, or 331 points. Tuesday's advance was the fourth-biggest point gain of the year for the blue-chip indicator.

Financial institutions, including AIG (AIG, Fortune 500), Bank of America (BAC, Fortune 500) and Citigroup (C, Fortune 500) led gainers, while Chevron (CVX, Fortune 500) was the only Dow stock to decline.

The broader Standard & Poor's 500 (SPX) index was up 2.9%. The tech-heavy Nasdaq composite (COMP) index advanced 2.8%.

Tuesday's rally was sparked early on by declines in the price of oil. But crude prices could be volatile Wednesday after the government releases its weekly energy inventory report.

Also on Wednesday, embattled mortgage financier Freddie Mac (FRE, Fortune 500) is due to report quarterly results before the opening bell.

The government-backed mortgage giant, along with its counterpart Fannie Mae (FNM, Fortune 500), will be receiving financial advice from Wall Street firm Morgan Stanley (MS, Fortune 500), the brokerage said Tuesday.

Federal Reserve: In a widely expected move, the Federal Reserve left its key fed funds rate unchanged at 2%.

The central bank, in its accompanying statement, said "economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports," and that it expects "moderate economic growth" over time.

Those comments allayed some fears about the health of the nation's economy. But the Fed statement also said inflation "has been high" and remains a "significant concern."

Overall, it was a carefully balanced statement, according to Art Hogan, chief market strategist at Jefferies & Co.

"There's something in there for everyone," Hogan said of the statement. "It's hawkish enough for people who are concerned about inflation, but the fact that there are dissenters proves that this [opinion] is not unanimous," he said.

Richard Fisher, president of the Federal Reserve Bank of Dallas, who has been a vocal supporter of actively combating inflation, preferred an increase in the target for the federal funds rate.

The Fed started cutting rates last year in response to economic weakness brought about by the housing market downturn and ensuing credit crisis. But rising prices have prompted speculation that the central bank will need to raise rates to help fight inflation.

Oil: The Fed's decision came amid a broad selloff in the oil market. Crude prices have fallen to a three-month low amid signs that global demand for petroleum products is softening.

Light, sweet crude for September delivery fell $2.24 to settle at $119.17 on the New York Mercantile Exchange.

Falling oil prices tend to support stocks because many investors think cheaper crude will continue the downward trend in gasoline prices. That would relieve some of the pressure on consumers and encourage them to spend more on discretionary items, boosting economic activity and stock prices.

Other commodities, including precious metals and crop futures, also declined.

Earnings news: After the close, Cisco Systems (CSCO, Fortune 500) posted fiscal fourth-quarter earnings and revenue that topped analysts' forecasts.

The maker of computer networking gear posted a fiscal fourth-quarter profit of $2 billion, or 33 cents a share, up 5% from the year-ago $1.9 billion, or 31 cents a share.

Excluding certain costs, earnings rose to 40 cents a share from 36 cents a year earlier. Analysts surveyed by Thomson Financial were looking for a 39-cent per share profit on sales of $10.31 billion.

Cisco is viewed as a economic bellwether. The company supplies much of the technology sector with basic components and market participants are eager to hear what CEO John Chambers has to say regarding the level of demand the company sees from its buyers.

Media conglomerate News Corp (NWS, Fortune 500). reported that fiscal fourth-quarter earnings jumped 27% on profit from the sale of assets and gains in its film, cable networks and newspaper units.

The company said net income rose to $1.13 billion, or 43 cents per share, from $890 million, or 28 cents per share, a year ago. That topped the 34 cents per share gain that analysts polled by Thomson Financial had forecast.

High-end grocery store Whole Foods (WFMI, Fortune 500) said net income tumbled 30% in its fiscal third quarter due largely to acquisition costs associated and lackluster consumer spending.

The company reported that it earned $33.9 million, or 24 cents a share, for the fiscal quarter ending July 6, down from $49.1 million, or 35 cents a share, in the same quarter last year. That fell short of the 31 cent per share gain that Wall Street was looking for.

Earlier in the day, consumer staples giant Procter & Gamble said fourth-quarter profit soared 33%, thanks to price increases, overseas sales and tax benefits.

P&G (PG, Fortune 500) said profit rose to $3.02 billion, or 92 cents per share, from $2.27 billion, or 67 cents per share, a year earlier.

Excluding tax benefits, the company earned 80 cents per share. Analysts surveyed by Thomson Financial expected 78 cents per share.

On the down side, Archer Daniels Midland (ADM, Fortune 500) said fiscal fourth-quarter profit was hurt by higher commodity prices.

The industrial agriculture company said profit fell 61% to $372 million, or 58 cents per share. Sales for the quarter rose to $21.78 billion.

From the housing sector, homebuilder D.R. Horton (DHI, Fortune 500), said it narrowed its fiscal third-quarter loss on less severe write-downs of their properties.

The company posted a loss of $339 million, or $1.26 per share, in the quarter ended June 30, compared with a loss of $823.8 million, or $2.62 per share, last year.

The results included pretax charges of $330.4 million to write down the value of inventory and other items. Analysts expected the builder to report a loss of 70 cents per share, though most analysts exclude one-time charges.

Economic news: The nation's service-oriented businesses remained in contraction in July, although by not as much as the month before, according to the Institute for Supply Management.

The ISM, a trade group of purchasing managers, said its reading of the service sector was 49.5 in July, up from 48.2 in June. That's better than economists' prediction of a reading of 48.7, according to the consensus estimate of economists surveyed by Briefing.com.

A reading below 50 signals contraction, while a reading above 50 indicates growth.

Other markets: In Asia, stocks finished mixed. European markets rallied.

Bond prices were mixed. The benchmark 10-year note declined 3/32 to 99 6/32, lifting its yield to 3.97% from 3.96% late Monday. Bond prices and yields move in opposite directions.

The 30-year long bond rose 2/32 to 96 18/32 with a yield of 4.59%. The 2-year note slipped 2/32 to 100 11/32 , raising its yield to 2.56%.

Gold prices tumbled $21.70 to $886.20 an ounce in New York.

The dollar edged higher against the euro. The 15-nation currency bought $1.5466, down from $1.5584 the day before. The dollar slipped to ¥108.10 from ¥108.26. ![]()