Danger years: How to save your nest egg

The market crash has thrown a wrench in retirement plans for many baby boomers. Here's how to minimize the damage.

|

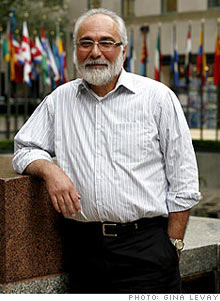

| Lawrence Ferreira: "If my 401(k) were any more underwater, I'd be drowning." |

(Money Magazine) -- Lawrence Ferreira, 56, has become bear-market road kill. The New York City attorney's 401(k) plan, which is split between four stock funds, is down 35% this year, erasing tens of thousands of dollars in retirement assets.

Worse, Ferreira isn't sure what to do next, other than contemplate more years on the job. "I had always planned to retire at 62," he says. "Now I'm afraid I might not be able to do that."

Ferreira is not alone. The market crash has stalled the once on-course retirement plans of hundreds of thousands of investors. If you are 10 or 20 years away from retirement, today's bear market probably shouldn't upset your golden years, or change how you save and invest for it. After all, there are likely to be enough bull markets between now and when you quit working to make up for today's twists and turns.

But if you are a boomer like Ferreira and closing in on what you'd hoped would be the tail end of your working years, repairing your retirement is a much tougher proposition. You don't have as much road to cover before you need to exit. Diversification might have made the recent crash into more of a fender bender. But a sensible asset allocation strategy alone wouldn't fix your 401(k).

Let's assume that, like Ferreira, all of your money is in U.S. stocks. That would mean your 401(k) would down 28% from last October's market peak. (Ferreira's portfolio is off even more because his largest holding, the Fidelity Magellan fund, has lost more than the average fund.) Let's also assume that you are five years away from retirement. That means you have to make up the 28% loss by the year 2013.

That's not easy, but you're retirement isn't totaled. Below are the things you can do to boost your retirement income.

One option is to cut back on spending and put more into your retirement accounts. The problem with this approach is that you need to save a lot more, and in more than just your 401(k), to make up for your losses. So much so that it is probably not doable unless you enjoy some sort of windfall.

Let's assume that before the crash you had $500,000 in retirement savings. That means your 401(k) would now be down to $360,000. To make up the difference in five years, you would have to save an additional $2,800 a month.

And that's only if the market starts going up again at the historic 8% a year. If the market continues to drop or treads water, you would have to put away even more. (If you can save more, keep in mind that you can put an additional $5,000 a year in your 401(k) if you are 50 or older.)

A more feasible remedy is to work a few more years. "Adding contributions is not that helpful," says Christine Fahlund, a senior financial planner at T. Rowe Price. "Working more is what really makes a difference."

This strategy boosts your retirement income in two ways. First of all, you can contribute to your 401(k) for longer, adding to your savings. But more important, every extra year of work means one less year you have to live off your savings. You can make bigger retirement withdrawals because you're spreading that nest egg over fewer years.

A recent study by T. Rowe Price found that by working an additional six years, you can boost your retirement account withdrawals by 28% - and that assumes you don't contribute anything else to your savings during those six years.

Of course, working until you are in your late 60s might be just as far-fetched as investing an additional $3,000 a month. But if you combine the two strategies - save more and work longer - you may find a solution.

Here's the math: Assume you make $100,000 a year and can save $15,000 a year, or $1,250 a month. By doing so, you will be able to boost your annual retirement income by 28% in just under four years. Boost that annual savings to $25,000 a year, or $2,083 a month, and you cut the years you have to work in retirement to make up for the market losses in half, to just three years.

Of course, no matter what you need to diversify that portfolio so you don't end up in the same peril again. An allocation of 60% of your portfolio in stocks and 40% of your portfolio in bonds makes sense if you are five years or less away from retirement.

Had you had that allocation going into the current market meltdown, your portfolio would be down only 17.5%. That still doesn't sound great. But it would take a year less of extra work to make that back. Put another way, the return of a diversified portfolio is an extra 365 days of retirement, and that's not too bad. ![]()