$700 billion bailout to get first audit

Government Accountability Office to deliver an oversight report to Congress on the $700 billion bailout plan.

NEW YORK (CNNMoney.com) -- The federal government's $700 billion financial rescue plan will get its first official review Tuesday.

The Government Accountability Office will present Congress with a report Tuesday on the bailout's progress and the Treasury Department's handling of the program. It is the first of a series of reports that the GAO must submit to lawmakers on a bi-monthly basis, as one of three oversight components required by the Emergency Economic Stability Act.

The bailout has received its fair share of criticism from lawmakers and economists. Some argue that Treasury should require banks to use their capital injections for lending to other financial institutions. With the credit markets still largely frozen, Treasury had hoped the fresh capital would encourage banks to lend, but some have used bailout funds to finance purchases of other institutions instead.

Other critics of the bailout have said the bailout does not address the housing market, which most economists point to as the root of the recent economic downturn.

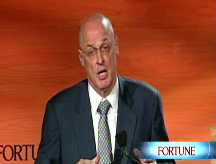

But Treasury Secretary Henry Paulson, along with Federal Reserve Chairman Ben Bernanke defended the massive plan, saying the new liquidity initiatives will take time to restore the markets to normalcy.

"We expect banks to increase their lending as a result of these efforts and it is important that they do so," Paulson said Monday at a Fortune 500 Forum. "This lending won't materialize as fast as any of us would like, but it will happen much, much faster as confidence is restored."

The Treasury so far has injected $150 billion in capital into the financial system by buying preferred shares in 52 institutions. Paulson said Monday that the department is reviewing hundreds of applications from banks seeking funding.

Even though the bailout bill was passed Oct. 3, the other two oversight bodies - a five-member congressional oversight panel and an inspector general - weren't named until mid-November.

President Bush nominated Neil Barofsky, a New York federal prosecutor, as EESA's inspector general. Despite bipartisan support for his nomination in the Senate Banking Committee, the nomination was blocked, and confirmation proceedings are expected to continue.

The congressional panel is made up of New York state Superintendent of Banks Richard Neiman, Harvard law professor Elizabeth Warren, AFL-CIO Associate General Counsel Damon Silvers, Rep. Jeb Hensarling, R-Texas, and Sen. Judd Gregg, R-N.H. The panel is expected to produce a report on the status of the bailout by the end of the year. ![]()