Treasury prices spiral lower

Government debt prices retreat from earlier highs as the Treasury announces more than $100 billion worth of debt coming to the block.

NEW YORK (CNNMoney.com) -- Government debt prices turned sharply lower Thursday after the Treasury announced more than $100 billion worth of new issuance headed to market.

An already shaky and thin trading day was further eroded by ratings agency Standard & Poor's lowering its outlook on Britain to negative.

S&P said Britain's debt could near 100% of GDP and warned it could downgrade the country's AAA credit rating. The worries overflowed into U.S. assets, said Kim Rupert, analyst at Action Economics.

"Investors connected the dots," Rupert said. "It would be unusual to see a U.S. downgrade, but investors know we're suffering from the same problems as Britain."

In an attempt to help solve some of those problems, the U.S. government has been issuing new debt at a breakneck pace to fund economic recovery efforts. That increased supply continues to weigh on prices.

At the same time, the government is buying back Treasurys in an effort to stimulate demand and keep yields in check. The Fed bought $7.4 billion worth of debt Thursday as part of its $300 billion buyback program. On Wednesday, the Fed bought $7.7 billion in debt maturing between February 2016 and May 2019.

The Treasury said Thursday that it will auction $40 billion in 2-year notes, $35 billion in 5-year notes, and $26 billion in 7-year notes next week. The $101 billion was slightly less than what some economists had predicted, but nonetheless served as a reminder of the volume of debt in the pipeline.

"The funding need should continue to expand, as tax receipts are falling short of expectations given the weakness in the economy," said Nick Kalivas, vice president of financial research at MF Global, in a research note.

Treasurys had rallied late Wednesday and into Thursday morning after the Fed issued a gloomy outlook, with an expectation for higher unemployment and a steeper drop in economic activity.

"There appears to be plenty of excess capacity in the global economy," said Kalivas. "Growth is not expected to rise fast enough to lower the unemployment rate."

Investors seek the safety of government debt in the face of economic weakness.

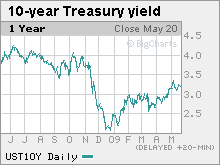

Bond prices: The benchmark 10-year note fell 1-8/32 to 98-5/32, and its yield rose to 3.35% from 3.19% late Wednesday. Bond prices and yields move in opposite directions.

The 30-year bond sank 2-19/32 to 99-4/32, and its yield rose to 4.3% from 4.16%.

The 2-year note edged down 1/32 to 100-2/32, and its yield rose to 0.86% from 0.82%.

The yield on the 3-month note held steady at 0.18%.

The bond market closes at 2 p.m. ET Friday ahead of the Memorial Day holiday in the United States.

Lending rates: A key bank-to-bank lending rate fell to another all-time low Thursday, an indication that banks were increasing their lending.

The 3-month Libor fell to 0.66% from 0.72% Wednesday, according to Bloomberg.com. Two weeks ago, the 3-month rate dropped below 1% for the first time since 1986, when the British Bankers Association started keeping records. The overnight Libor rate was unchanged at 0.22%.

Libor, the London Interbank Offered Rate, is a daily average of rates that 16 different banks charge each other to lend money in London. The closely watched benchmark is used to calculate adjustable-rate mortgages. More than $350 trillion in assets are tied to Libor. ![]()