Fidelity Contrafund open for business

A close look at Fidelity's Contrafund - a conservative growth fund that beats its aggressive peers.

(Money Magazine) -- Over the past decade, Fidelity Contrafund manager Will Danoff did something the stock market couldn't: He made money, returning 2.3% a year. His fund also beat 95% of the portfolios that invest in large, fast-growing companies.

Yet unless Contrafund was an option in your 401(k), you probably couldn't invest in it during the bear market. Fidelity shuttered the popular stock fund to new investors in 2006.

Now that the fund has reopened, here are some things you should know.

Overseeing $52 billion has its privileges.

For instance, when Danoff calls, CEOs pick up the phone. But the fund is also limited by the enormous amount of money it oversees. "Managing Contrafund is like trying to turn a tanker," says Morningstar fund analyst Christopher Davis.

Despite the fund's size, Danoff says there is still a place in Contrafund for small and midsize stocks -- in fact, they make up 19% of the portfolio. But he admits that even if he made a brilliant call on a smaller stock today, it would have a negligible impact on the overall fund.

As the fund has grown, so has the size of its average stock. It's now twice as big as it was five years ago, when the fund managed $39 billion.

While Danoff, who's been running Contrafund for nearly 20 years, invests in growth companies, he does so in a conservative manner.

For starters, he doesn't try to bet on hot sectors, as many of his peers are doing with energy stocks now. He simply looks for fast-growing companies regardless of industry. And because he favors conservative firms with low debt, his fund is filled with high-quality stocks such as Johnson & Johnson (JNJ, Fortune 500) and McDonald's (MCD, Fortune 500).

His love of cash-rich companies has recently led him to technology stocks -- his top holding is Google (GOOG, Fortune 500). But he's still light in tech relative to the S&P 500 large-cap growth index, a sign he's not interested in owning just any fast grower.

Danoff used the 2008 bear market as an opportunity to stock up on high-quality companies.

"A selloff is a great chance to upgrade the quality of your portfolio," he says. But since high-quality stocks have lagged in the recent rally, Contrafund trails 80% of its peers year to date.

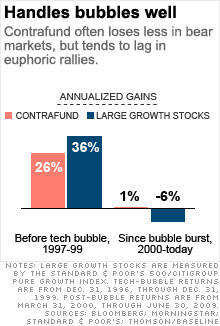

It's not unusual for Contrafund to lag in euphoric times. It under-performed large growth stocks by 10 percentage points a year during the tech bubble of 1997-99. But after the bubble popped in 2000, Danoff crushed them by 12 points annually in the 2000-02 bear market.

Says Jim Lowell, editor of the Fidelity Investor newsletter: "He's shown a remarkable ability to dodge most of the market's big disasters." ![]()