Choppy day on Wall Street

A stronger greenback drags on commodity prices, pressuring markets. Fed Chairman Ben Bernanke cools rate hike fears.

NEW YORK (CNNMoney.com) -- Stocks were mixed late Monday at the end of a choppy session impacted by a strong dollar, falling oil and gold prices and comments from Fed Chairman Ben Bernanke that cooled worries about higher interest rates.

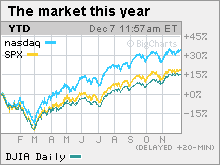

The Dow Jones industrial average (INDU) was barely changed. The S&P 500 index (SPX) lost 3 points, or 0.3%. The Nasdaq composite (COMP) shed 5 points, or 0.2%.

Stocks seesawed through the session as investors weighed Bernanke's comments and the direction of the dollar and commodity markets in the aftermath of last week's big payrolls report.

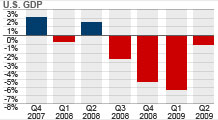

Stocks gained Friday at the end of a bumpy session following a better-than-expected November jobs report. The report showed employers cut just 11,000 jobs from their payrolls, the smallest amount since the start of the recession in December 2007. The report also showed the unemployment rate fell to 10% from a 26-year high of 10.2% in October.

The report was another strong sign that the economy had turned a corner, but it also raised questions about whether the Federal Reserve will need to raise interest rates faster than has been expected. If the economy is improving at a faster pace than expected, long-term inflation threats could come into play.

Such concerns kept the market churning Monday morning, sending the dollar higher and dollar-traded commodities lower as investors eschewed riskier assets.

But in the afternoon, Fed Chairman Ben Bernanke seemed to downplay the likelihood of a rate hike, saying in a speech at the Economic Club of Washington that it is too soon to say whether the slowly-germinating recovery will last. The Fed has kept short-term interest rates at historic lows near zero for a year and is expected to continue to do so to support the recovery.

Bernanke also said that the central bank will make money on the trillions it has pumped into the economy over the last two years.

Bank stocks were among the big decliners, with the KBW Bank Sector (BKX) index losing 1.6%. Railroads, trucks and airlines slipped too, with the Dow Jones Transportation (DJT) average losing 1%.

Bailout: The Obama administration is expected to cut the cost of the bank bailout plan by almost 60%, in a move that could help trim the ballooning deficit. The White House is expected to announce in coming days that it will slash the cost of the Troubled Asset Relief Program (TARP) by $200 billion, bringing the long-term cost to $141 billion.

The money not used for the TARP could be used toward creating a new national jobs program or for paying down the deficit.

Consumer credit: Americans borrowed less in October, for a record ninth straight month, according to a Federal Reserve report released Monday.

Consumer credit fell at an annual rate of $3.51 billion in October after falling at an $8.77 billion annual rate in September. Economists surveyed by Briefing.com thought it would rise to a $9.3 billion annual rate.

Gold prices slump: COMEX gold for February delivery fell $5.50 to settle at $1,164 an ounce. Gold closed at an all-time high of $1,218.30 an ounce last week. Dollar-traded gold tumbled as the dollar firmed up.

The dollar and oil: The dollar gained versus the euro and slipped against the yen, causing dollar-traded oil prices to slide.

U.S. light crude oil for January delivery fell $1.74 to settle at $73.93 a barrel on the New York Mercantile Exchange.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.42% from 3.47% late Friday. Treasury prices and yields move in opposite directions.

World markets: Overseas markets were mixed. European markets fell, with London's FTSE 100 and France's CAC 40 both losing around 0.2% and Germany's DAX down 0.5%. Asian markets ended mostly lower, with the exception of Japan's Nikkei, which gained 1.5%.

Market breadth was mixed. On the New York Stock Exchange, winners beat losers eight to seven on volume of 1.06 billion shares. On the Nasdaq, advancers narrowly edged decliners on volume of 1.89 billion shares. ![]()