Search News

We donate too!

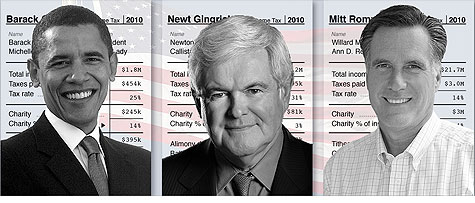

NEW YORK (CNNMoney) -- President Barack Obama and Oval Office hopefuls Newt Gingrich and Mitt Romney have all released at least one year of tax returns. And they all gave big money to charity.

But their donation patterns differ substantially, and in some cases provide a window into the candidate's political priorities.

Obama gave $245,075, or 14.2% of his $1.7 million in income to charity in 2010, the only year tax returns are available for all three candidates. Romney donated almost $3 million, or 13.8% of his income, while Gingrich gave $81,133, or 2.6% of his income, to charity.

Compared to peers with similar income, Obama and Romney did far more than most.

"Romney and Obama are very generous charity-wise," said CharityWatch president Daniel Borochoff. Gingrich is still doing pretty well, but Borochoff said his giving level is "more like an average donor for the income."

Rick Santorum and Ron Paul have yet to release their tax returns, but here's a breakdown for the president and the two Republican frontrunners:

Romney

In addition to his 2010 return, Romney has released an estimate for 2011.

The deep-pocketed former Bain executive gave $2.98 million in 2010, and $4.02 million the following year. That works out to 16.4% of his $42.6 million in aggregate income over the two-year period.

"This is a huge percentage of his income," said Russell James III, a professor who teaches charitable planning at Texas Tech. "But when you look at the number as a percentage of his total assets, it's not that dramatic."

Romney, with an estimated net worth between $85 million and $264 million, directed large portions of his donations to the Church of Jesus Christ of Latter-day Saints, also known as the Mormon church.

In 2011, the Romney's gave $2.6 million in cash contributions to the church, and in 2010 they gave $1.5 million.

All Mormons in good standing with the Church of Jesus Christ of Latter-day Saints are required to give 10% of their salaries as a tithe.

Borochoff said that as a result of his religious background, Romney comes from "a tradition of generosity."

"Mormons are generous people with their charity," Borochoff said. "You don't have to guess which state gives most per capita. It's Utah."

The Romney's also gave substantial cash and non-cash gifts to their family foundation, called the Tyler Foundation.

In 2010, the foundation -- which has assets of $10 million -- made donations to the Mormon church, Harvard Business School, City Year, the George W. Bush Library and the Boys and Girls Club of Boston, among others.

James said it is not uncommon for very wealthy individuals to establish foundations, a strategy that gives them more control over how the money is used.

Obama

Obama has released tax returns for at least 11 years, dating back to 2000.

All told, Obama donated 6.3% of his income to charity over the period, which works out to a total of $1.1 million. The pace of those donations has increased in recent years, a trend that mirrors an uptick in the president's income.

From 2000 to 2004, the Obamas gave around only 1% of their income to charity. From 2005 to 2009, their donations jumped to between 4% and 7% of income, before increasing to 14% in 2010.

After winning the Nobel Peace Prize in 2009, the president requested his $1.4 million in winnings to be donated to various charities, a gift that was not reported as income on his tax returns.

From that prize, the president gave $250,000 to Fisher House, $200,000 to the Clinton-Bush Haiti fund, $125,000 to the United Negro College Fund, $125,000 to the Appalachian Leadership and Education Foundation, among others.

In recent years, Obama has spread his donations around, giving to groups as diverse as the American Red Cross, the University of Hawaii foundation, the National AIDS Fund and the Greater New Orleans Foundation.

Gingrich

Gingrich has released only one year of tax returns so far this election cycle, which makes it difficult to determine how the former speaker's charitable habits have changed over time.

According to his 2010 return, he gave $81,133 to charity while earning $3.2 million in income.

It's mostly unclear which organizations he donated to.

The only obvious one: Gingrich and his wife Callista donated $9,540 to the Basilica of the National Shrine of the Immaculate Conception in Washington.

The tax return also shows Callista received $5,918 in income from the church, where she is a member of the choir.

Gingrich, who donated 2.6% of his income to charity, is pretty much in line with his millionaire peers when it comes to charitable giving, according to Borochoff and James.

And while Obama and Romney appear to be even more generous, it's difficult to tease out motivations when it comes to charity, especially for politicians.

"It's a basic psychological reality that if you know several million people are going to be looking at your tax returns, you are going to give more than is typical in the general population," James said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |