Search News

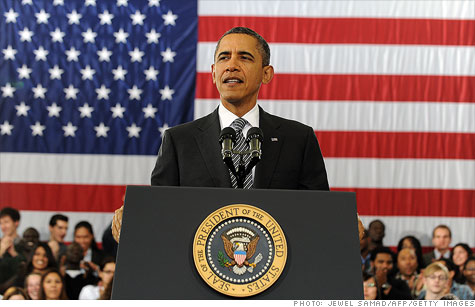

On Monday, President Obama unveiled his 2013 budget proposal that the White House estimates will stabilize the debt by 2018.

NEW YORK (CNNMoney) -- Independent deficit hawks -- as opposed to the political ones seeking votes -- gave mixed reviews to President Obama's 2013 budget proposal.

They commended the president for offering measures that would start to move U.S. fiscal policy in a more sustainable direction.

But they said his budget as a whole does not go far enough: It fails to really tackle costs for the big entitlement programs such as Medicare, which they say will be essential if lawmakers want to reduce the country's long-term debt.

Obama's budget, released Monday, would stabilize the debt -- meaning the country's accumulated deficits would stop growing faster than the economy -- starting in 2018, according to White House estimates.

And over the next decade, his policies would reduce deficits by roughly $4 trillion when combined with the $2.1 trillion in deficit reduction called for under the Budget Control Act.

"While his budget stabilizes debt over the next decade, the real problem arrives thereafter, as entitlement costs spiral out of control and revenues are inadequate to deal with a wave of retiring baby boomers," former White House budget office director Alice Rivlin and former Senate Budget chairman Pete Domenici said in a statement.

Rivlin and Domenici, now at the Bipartisan Policy Center, chaired a debt reduction task force that proposed $6 trillion in budget savings phased in over the next decade while simultaneously calling for near-term economic stimulus.

The Concord Coalition, a deficit watchdog group, commended Obama for taking a broad approach to deficit reduction rather than one that leans too heavily on cutting discretionary spending. (Here's where the president proposes cuts.)

In particular, Concord and the Committee for a Responsible Federal Budget gave good marks to the president for acknowledging that health care is a key driver of the country's debt. His budget proposal would save an estimated $360 billion in health care spending through a variety of proposed changes to Medicare, Medicaid and other health programs.

Nevertheless, $360 billion is a "very, very small" number in the context of the savings needed over time to stabilize the financing for those programs, said Robert Bixby, Concord Coalition's executive director.

Another plus: On the tax front, Obama "identifies a number of specific revenue-raising measures to ensure that deficit reduction materializes regardless of whether or not tax reform does," CRFB president Maya MacGuineas said in a statement.

At the same time, budget experts are not offering high-fives to the administration for claiming $848 billion in war savings from the winding down of the wars in Iraq and Afghanistan. It's a move they consider to be pure hokum.

"Drawing down spending on wars that were already set to wind down and that were deficit financed in the first place should not be considered savings. When you finish college, you don't suddenly have thousands of dollars a year to spend elsewhere -- in fact, you have to find a way to pay back your loans," MacGuineas noted.

Jacob Lew, Obama's new chief of staff and his former budget director, said the budget's lower caps on war spending is necessary to prevent spending creep and locking in the savings.

"I guarantee you that if we don't take the action that's been proposed, there will be leakage, and that money will end up being spent," Lew said on Fox News Sunday.

Obama's budget uses $617 billion of the $848 billion in claimed war savings for deficit reduction and allocated $231 billion of the money to pay for surface transportation projects. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |