Search News

NEW YORK (CNNMoney.com) -- Great. The global economy finally starts to show signs of emerging from the recession and now a possible trade war between the U.S. and China is throwing a monkey wrench into the recovery.

The U.S. just slapped a 35% tariff on tires imported from China, beginning Sept. 26.

And in a move that doesn't look like mere coincidence, the Chinese government announced Sunday that it is launching a probe into possibility of the U.S. dumping auto parts and chickens on the Chinese market.

This is not good news. This spat could have a major impact on more than just Goodyear Tire & Rubber (GT, Fortune 500), Cooper Tire & Rubber (CTB) and poultry producer Tyson Foods (TSN, Fortune 500).

If the tension between the U.S. and China escalates into a full-blown bout of global protectionism, we might need to kiss the notion of an economic recovery goodbye. This could be the start of that much-feared double dip into another recession.

Or as Michael Corleone said in an often parodied line from the "The Godfather: Part III": "Just when I thought I was out ... they pull me back in!"

On the one hand, it makes sense for the White House to try and enforce existing trade laws so that U.S. tire makers can compete more effectively with cheaper tires imported from China.

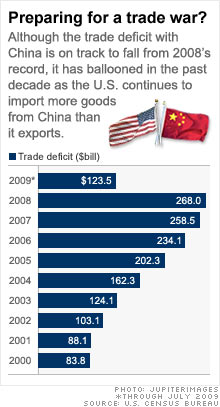

The trade deficit with China has soared in recent years, hitting a record high in 2008. This is a concern for obvious reasons: If we continue to buy a lot more from China than we sell to them, more U.S.-based manufacturing jobs could be lost.

"It's not uncommon for the government to side with certain industries to protect American workers," said Keith Hembre, chief economist with First American Funds in Minneapolis. "These tariffs wouldn't be happening if the unemployment rate was substantially lower."

But we've been down this road before. The launching of tariffs during a severe economic slowdown has done more harm than good in the past.

Many historians blame the Smoot-Hawley Tariff Act of 1930, which raised tariffs to their highest levels ever, for making the Great Depression worse.

Protectionism is a bad idea. In this increasingly globalized economy, it just doesn't make sense to alienate trading partners.

"One would hope we can avoid more of this. There is no positive side to raising tariffs," said Kurt Karl, chief U.S. economist with Swiss Re. "In this global crisis, you want global cooperation. This doesn't help."

And that's especially true with China since it is also the largest foreign holder of U.S. Treasury debt, owning about $776 billion of Treasurys as of June.

If the Chinese stopped buying Treasurys -- or worse started selling them en masse -- it could have a catastrophic effect on the dollar and the nation's fiscal state as a whole.

"A trade war would be very detrimental to the U.S. and the global economy," said Michael Pento, chief economist with Delta Global Advisors, Inc., a money management firm. "We should have fair, open trade. But our banker right now is the Chinese, and it's best not to bite your banker's hand."

Karl isn't too concerned that China would dump Treasurys. He argues that would be the equivalent of China shooting itself in the foot since it would further erode the value of its holdings.

Nonetheless, Karl does worry that China could retaliate against the tire tariff with tariffs of its own and even more government subsidies of Chinese manufacturers. That could make the trade deficit worse.

But at least one economist thinks cooler heads will eventually prevail and that the brouhaha over tires won't lead to the China and U.S. levying more tariffs on other goods.

Michael Strauss, chief economist with Commonfund, a money management firm based in Wilton, Conn. said there is not going to be a repeat of the mistakes of Smoot-Hawley.

Strauss said both the U.S. and Chinese are smart enough students of economic history to know that the last thing the world needs now is for arguably the two most important economic powers to turn a spat over tires and chickens into something that could derail a global rebound.

"This is not that big of a deal. You get these battles once in a while and they pass. This is not reminiscent of what happened 80 years ago," he said. "Deep down, the U.S. and China know that they need one another. There's going to be more negotiation than retaliation."

Here's hoping that he's right.

Talkback: Would a trade war between the U.S. and China be a bad thing? Or should the U.S. be more protectionist to try and save jobs? Share your comments below. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |