Search News

NEW YORK (CNNMoney.com) -- Fears about the fallout from a growing debt crisis in Europe dragged on Wall Street Thursday, sending the market to its lowest close in three months, with stocks hit across the board.

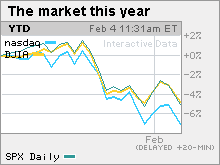

The Dow Jones industrial average (INDU) tumbled 268 points, or 2.6%, closing at 10,002.26, its lowest point since Nov. 4. The blue-chip briefly dipped below 10,000 late in the day, falling to that level for the first time since early November.

The Dow's decline marked the biggest one-day point loss since March 5 of last year.

The S&P 500 index (SPX) sank 34 points, or 3.1%, closing at the lowest point since Nov. 4. The one-day point loss was the biggest since April 20, 2009.

The Nasdaq composite (COMP) fell 65 points, or 3%, and closed at its lowest point point since Nov. 6. The one-day point loss was the largest since Feb. 10, 2009.

Debt woes propelled the dollar to a more than seven-month high versus the euro, which in turn pummeled dollar-traded commodities such as oil and gold. Treasury prices spiked, lowering yields, in a classic flight-to-safety move.

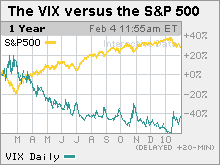

Meanwhile, the VIX (VIX), Wall Street's fear gauge, spiked almost 21%, suggesting investor nervousness was increasing.

"A surprise rise in weekly jobless claims ahead of tomorrow's non-farm payrolls report in combination with the sovereign debt issue has got people a bit spooked today," said Mikel Keifer, vice president at Jurika Mills & Keifer.

Keifer said concerns about Greece's debt problems have been in play for a while, but now Spain and Portugal are joining the fray.

Reports of labor unrest and political problems in the troubled nations are adding to the nervousness. "The worries are coming more to the forefront as market participants wonder if these countries will be able to refinance the debt," Keifer said.

The stronger dollar sent oil and gold prices lower, and stocks such as Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) sliding. With energy one of the biggest sectors in the S&P 500, the selloff in the sector dragged on the broader market.

Weaker-than-expected labor market reports on both Wednesday and Thursday also played a role, creating jitters ahead of Friday's January jobs report. Employers are expected to have added 15,000 jobs to their payrolls after cutting 85,000 in the previous month while the unemployment rate is expected to hold steady at 10%.

If the payrolls number varies dramatically, it will likely move the market one way or another. But short of that, markets are likely to remain focused on the debt issues, said Joe Clark, market analyst at Financial Enhancement Group.

"The big issue at hand right now is that these European countries are facing debt crises and no one is sure what kind of impact that may have on the global economy," Clark said.

Rally loses steam: Stocks rallied in the last 9 months of 2009 as investors dug back in after a brutal start to the year. The S&P 500 gained 65% between the 12-year lows hit on March 9 and year-end.

That advance continued up until around Jan. 19 of this year. But between that Jan. 19 high and the end of January, the S&P 500 lost just short of 7%.

"The market is in a pessimistic mood today, but this is also an extension of the correction we saw in late January," said Matt King, chief investment officer at Bell Investment Advisors. "We saw a 7% decline, but we probably need to see double-digits (in percentage) before the selloff is over."

Stock declines Thursday were broad based, with 29 of 30 Dow stocks falling. The exception was Cisco Systems, which reported strong quarterly results late Thursday.

Jobs: The number of Americans filing new claims for unemployment rose to 480,000 last week from a revised 472,000 the previous week, the Labor Department reported. Economists surveyed by Briefing.com expected 455,000 new claims.

Continuing claims, the number of Americans receiving benefits for a week or more, rose to 4,602,000 from 4,600,000 the previous week. Economists expected 4,581,000.

The report was the lead-in to Friday's big January jobs report from the government.

Beyond the monthly figures, investors will also take a look at the annual revision of U.S. payrolls. The Bureau of Labor Statistics is expected to say that 824,000 more jobs were lost than previously thought during the April 2008 to May 2009 period, indicating the recession was even deeper than had been thought.

Factory orders: December factory orders rose 1% versus forecasts for a rise of 0.5%. Orders rose 1% in the previous month.

Quarterly results: After the close of trading Wednesday, tech leader Cisco Systems (CSCO, Fortune 500) reported better-than-expected quarterly sales and earnings.

Toyota Motor (TM) reported improved earnings in its most recent quarter and also lifted its estimates for the fiscal year ending in March. But the results did not include the impact of the huge recall of millions of vehicles due to gas pedal problems. Toyota estimates that the global recall could cost it as much as $2 billion.

On Thursday, the government announced a formal probe into brake problems in the popular Prius hybrid. (Feds probing Prius brakes)

World markets: In overseas trading, Asian markets tumbled and European markets ended lower.

Commodities and the dollar: The dollar gained versus the euro on worries about sovereign debt in Greece, Spain and elsewhere in Europe. The dollar fell versus the Japanese yen.

The dollar's strength against the euro dragged on oil and gold prices and individual stocks.

COMEX gold for April delivery fell $49 to settle at $1,062.40 an ounce.

U.S. light crude oil for March delivery fell $3.84 to settle at $73.14 a barrel on the New York Mercantile Exchange.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.61% from 3.70% late Wednesday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers beat winners by over ten to one on volume of 1.48 billion shares. On the Nasdaq, decliners topped advancers by more than six to one on volume of 2.84 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |