Search News

NEW YORK (CNNMoney.com) -- Stocks ended a volatile session higher Thursday as investors welcomed improved retail sales and a report showing that the pace of job losses is slowing, ahead of Friday's big government employment report.

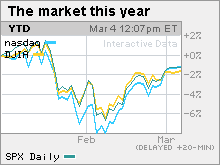

The Dow Jones industrial average (INDU) gained 47 points, or 0.5%. The S&P 500 index (SPX) added 4 points or 0.4% and the Nasdaq composite (COMP) gained 11 points or 0.5%.

The major indexes rose in the morning, flattened out around midday and managed gains again in the afternoon.

The strong dollar dragged on dollar-traded commodities as well as on shares of companies that do a lot of business overseas, and therefore benefit from a weaker dollar.

Wall Street ended little changed Wednesday as investors remained cautious over the jobs outlook and the strength of the recovery. That caution remained in place Thursday.

"We had some good news this morning with the jobs numbers and the retail sales, but I think the market is really waiting for tomorrow," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

The government releases its February jobs report before the start of trading Friday. The payrolls number is expected to show that employers cut 65,000 jobs in February, after cutting 20,000 in the previous month. The unemployment rate, generated by a separate survey, is expected to have risen to 9.8% from 9.7% in the previous month.

"Unless the actual payrolls number is way off-base, you're not going to see a big stock market reaction beyond the early morning," Kiddoo said.

But the report overall is key for the direction of the stock market beyond just Friday's session, he said, as investors look for signs that an economic recovery has legs.

Jobs: Ahead of Friday's big non-farm payrolls report, investors digested the government's weekly tallies.

The number of Americans filing new claims for unemployment fell to 469,000 last week from a revised 498,000 the previous week. Economists surveyed by Briefing.com thought claims would fall to 470,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4.5 million from a revised 4.634 million in the previous week. Economists thought claims would only drop to 4.6 million.

On Wednesday, reports from payroll services firm ADP and outplacement firm Challenger, Gray & Christmas showed the pace of job cuts is slowing as the labor market begins to stabilize. The nation's smallest companies may already be beginning to boost their employee rolls.

Home sales slump: The January pending home sales index plunged 7.6% -- far worse than expected -- as brutal storms on the East Coast kept potential buyers on the sidelines.

The report from the National Association of Realtors was a surprise to economists, who were expecting sales to rise 1%, on average, after rising a revised 0.8% in December.

Retail sales rise: Despite massive snow storms, shoppers picked up the pace in February, boosting total retail sales by 4%, according to sales tracker Thomson Reuters.

It was the sixth month in a row that same-store sales rose and the best monthly gains since November 2007, a month before the official start of the recession. Same-store sales is a retail industry metric that refers to sales at stores that have been open for a year or more.

Among the standouts, clothing chain Abercrombie & Fitch (ANF) reported that same-store sales rose 5% versus forecasts for a decline of 6.1%. Shares rallied 14%.

Factory orders: Factory orders climbed 1.7% in January, just shy of forecasts for a rise of 1.8%, the Commerce Department reported. Orders rose a revised 1.5% in the previous month.

Financials: Citigroup CEO Vikram Pandit thanked taxpayers for the $45 billion bailout received during the height of the financial crisis, but offered few details on why Citi needed a second bailout so quickly after the first one.

Pandit, speaking before a Congressional panel, said "irrational markets" and "short sellers" caused the company's stock to plunge and the bank to need an additional $20 billion within weeks of the original $25 billion.

Citi (C, Fortune 500) shares gained less than 1%.

Separately, the government said Thursday that it will make more than $1.5 billion from selling warrants it received as part of its 2008 bailout of Bank of America (BAC, Fortune 500).

World Markets: In overseas trading, European markets were little changed after the European Central Bank held its benchmark interest rate steady at 1% and the Bank of England held its rate steady at 0.5%. Both decisions were in line with expectations.

The London FTSE lost 0.1%, the German DAX lost 0.4% and the French CAC 40 lost 0.4%.

Asian markets ended lower, although the Japanese Nikkei rose 0.3%.

The dollar and commodities: The dollar gained versus the euro and the yen, pressuring dollar-traded commodities.

U.S. light crude oil for April delivery fell 66 cents to settle at $80.21 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery lost $11.50 to settle at $1,132.40 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.60% from 3.61% late Wednesday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers by a narrow margin on volume of 961 million shares. On the Nasdaq, advancers edged decliners by five to four on volume of 2.15 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |