Search News

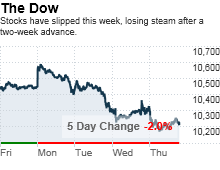

NEW YORK (CNNMoney.com) -- Stocks slumped Thursday, with the Dow losing 145 points, as investors mulled mixed reports on the economy and a sell-off in bank shares as Wall Street reform talk move toward a close.

Dow Jones industrial average (INDU) lost around 145 points, or 1.4%. The S&P 500 (SPX) lost 18 points or 1.7% and the Nasdaq (COMP) composite lost 37 points or 1.6%.

Stocks fell after reports showed a still-tough environment for the manufacturing and labor markets and one day after the Federal Reserve sounded a cautious tone on the economy.

The Fed issued a cautious growth outlook Wednesday on the back of the day's weak May new home sales report. That left stocks mixed to lower, but the tone turned even more negative overnight, with markets in Europe falling and U.S. stocks opening weaker.

"The Fed downgraded their economic outlook, which is not good for the markets," said David Chalupnik, head of equities at First American Funds. "It tells us that the economy is losing steam and earnings are at risk."

He said that markets are likely to be particularly volatile in July, as the second-quarter reporting period heats up, with many forecasts still too high relative to the current economic outlook.

Economy: The number of Americans filing new claims for unemployment fell to 457,000 last week from a revised 472,000 in the previous week, the Labor Department reported. Economists surveyed by Briefing.com expected 457,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4,548,000 from 4,571,000. Economists expected 4,580,000 continuing claims, on average.

Durable goods orders fell 1.1% in May, the Commerce Department reported. That was better than the 1.3% drop that was expected. Orders rose 3% in April.

Orders excluding transportation rose 0.9% in May versus forecasts for a rise of 1.3%. Orders ex-transportation fell 0.8% in the previous month.

On the upside, mortgage rates fell this week to the lowest level on record, a boon to individuals looking to buy a home or refinance. Freddie Mac said that the average rate for 30-year fixed loans fell to 4.69% from 4.75%.

Federal Reserve: On Wednesday, the central bank policymakers opted to hold interest rates steady at historic lows near zero, as expected.

However, in the statement the bankers said that while the economy is recovering, growth is likely to stay moderate for a while. Additionally, they were concerned about the weakness in the housing market and the "less supportive" financial conditions as a result of the European debt crisis.

Companies: Thousands of Apple fans lined up Thursday morning to buy the hugely anticipated iPhone 4, which is being released at Apple stores and other retailers Thursday including Wal-Mart Stores (WMT, Fortune 500) and Best Buy (BBY, Fortune 500).

Google (GOOG, Fortune 500) won a crucial copyright infringement battle with Viacom (VIA) Wednesday when a federal court ruled Google's YouTube isn't liable for its users' copyright violations. Viacom, which has been seeking more than $1 billion in damages, says it will appeal the ruling.

Oracle (ORCL, Fortune 500) shares dipped ahead of its quarterly profit report, due out after the close. The software maker is expected to earn 54 cents per share, up 17% from a year earlier, and revenue of $9.5 billion, up 38% from the prior year.

Declines were broad based, with 28 of 30 Dow issues falling. The biggest losers were Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), Walt Disney (DIS, Fortune 500), IBM (IBM, Fortune 500), Hewlett-Packard (HPQ, Fortune 500) and 3M (MMM, Fortune 500).

Financial shares tumbled as Washington lawmakers moved closer to reaching a compromise on two different versions of the Wall Street reform bill. The KBW Bank (BKX) sector index fell 2.2%.

Market breadth was negative and volume was pretty modest. On the New York Stock Exchange, losers beat winners three to one on volume of 1.26 billion shares. On the Nasdaq, decliners topped advancers three to one on volume of 2.06 billion shares.

Currency: The euro was little changed versus the dollar, erasing earlier gains but remaining well above the four-year low of $1.188 hit last week. The dollar was barely changed versus the yen. The direction of the euro and the state of global debt are expected to be in focus at this weekend's G-20 meeting.

World markets: European markets slipped. Britain's FTSE 100 lost 1.5%, Germany's DAX gave back 1.4% and France's CAC 40 fell 2.4%.

Asian markets were mostly lower. Japan's Nikkei ended little changed, Hong Kong's Hang Seng fell 0.6% and China's Shanghai Composite lost 0.1%.

Commodities: U.S. light crude oil for August delivery rose 22 cents to $76.51 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery gained $10.60 to $1,245.90 an ounce after closing at a record $1,258.30 last Friday.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.12% from 3.11% late Wednesday. Treasury prices and yields move in opposite directions. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |