Search News

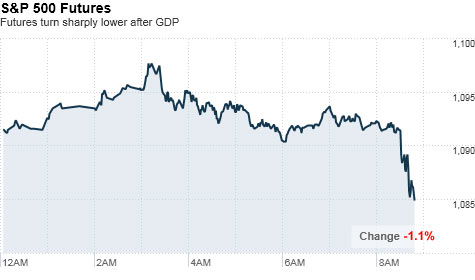

NEW YORK (CNNMoney.com) -- U.S. stocks were headed toward an early selloff Friday, following a weaker-than-expected reading on second-quarter economic growth.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were sharply lower ahead of the opening bell. Futures had already been pointing to a weak open but turned decidedly lower following the GDP report.

Futures measure current index values against perceived future performance.

Stocks slipped Thursday as cautious comments from a regional Federal Reserve president about the health of the economy spooked investors.

"The market is now focusing on economic activity," said Peter Cardillo, chief market economist at Avalon Partners. "The earnings story is basically over at this point, with earnings season turning out to be much better than expected."

Economy: Gross domestic product, the broadest measure of the nation's economic activity, rose at a 2.4% annual rate in the second quarter, down from an upwardly revised 3.7% in the first quarter.

Economists surveyed by Briefing.com had expected GDP to show a 2.5% annualized rate increase.

The Chicago PMI, a regional reading on manufacturing, is due out in the morning with economists forecasting it to have fallen to 56.3 in July from 59.1 in June, according to a consensus estimate from Briefing.com.

A revised reading on consumer sentiment from the University of Michigan is also due out. That reading is expected to have risen to 67.5 in July, up from the previously reported 66.5.

Earnings: Chevron (CVX, Fortune 500) posted second-quarter results that topped forecasts and said profit tripled in the quarter, but shares of the company fell modestly in pre-market trading.

Companies: The Walt Disney Company (DIS, Fortune 500) said early Friday it will sell Miramax Films for about $660 million to an investors group, Filmyard Holdings. Shares of Walt Disney were down nearly 1% ahead of the market open.

World markets: European stocks declined in morning trading. The CAC 40 in France fell 1%, the FTSE 100 in Britain slipped 1% and Germany's DAX dropped 0.9%.

Asian markets finished lower. The Shanghai Composite fell 0.4% and the Hang Seng lost 0.3%, while the Nikkei in Japan tumbled 1.6%.

Currencies and commodities: The dollar was up versus the euro and the British pound, but down against the Japanese yen.

U.S. light crude oil for September delivery fell $1.33 cents to $77.03 a barrel.

COMEX gold's December contract gained $1.40 to $1,172.60 per ounce.

Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 2.93% from 2.99% late Thursday. Bond prices and yields move in opposite directions.

How much of a hit did you take in the recent correction? Are you worried about a bear market? What changes have you made in your portfolio and what changes do you plan on making for the rest of the year? E-mail your story to realstories@cnnmoney.com and you could be featured in an upcoming article. For the CNNMoney.com Comment Policy, click here. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |