Search News

Click chart to track futures.

Click chart to track futures.

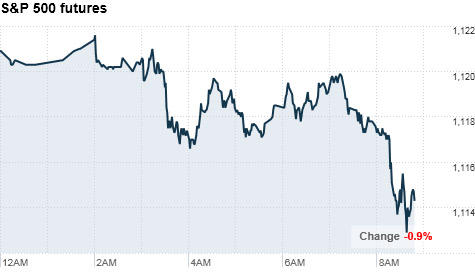

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to fall Tuesday, as investors eyed a drop in overseas markets and awaited the latest statement from the Federal Reserve.

Dow Jones industrial average (INDU) S&P 500 (SPX) and Nasdaq (COMP) futures were lower. Futures measure current index values against perceived future performance.

U.S. stocks kicked off the week on a positive note Monday, with the Dow gaining 0.4%, the S&P 500 adding 0.6% and the Nasdaq rising 0.8%.

But trading is expected to be choppy Tuesday as jittery investors wait for the Federal Reserve's statement from its latest monetary policy meeting, due at 2:15 p.m. ET.

The Fed is widely expected to keep interest rates at historic lows near zero, but investors will be more focused on what policymakers say about the recovery and their plan for propping up the economy.

"All eyes are on the Fed statement," said Art Hogan, chief market strategist at Jefferies & Co. "The market believes there could be a change in the Fed's tone, commentary or even policy that reflects the recent soft patch in the economy."

He added that the most likely outcome of the meeting is that the central bank will change its statement's language to be more in line with Fed chairman Ben Bernanke's warning to Congress last month, when he said the economic outlook is "unusually uncertain."

Hogan said a change in monetary policy in the statement in unlikely, but the Fed could indicate that it may take steps to stimulate the economy again in the future.

"Regardless of what the Fed does, investors will be disappointed," he said. "If it downgrades the outlook without taking action, investors won't be satisfied. And if the Fed does make changes, investors will be disappointed that those steps were so necessary."

Economy: Investors will also analyze a report that showed business productivity unexpectedly fell 0.9% in the second quarter, the first decline in 18 month. Economists expected growth to slow to 0.1% from an upwardly revised 3.9% in the first quarter, according to a consensus estimate from Briefing.com.

The Commerce Department will release a reading on June wholesale inventories, which economists expect increased by 0.4% during the month, following a 0.5% hike in May.

Companies: BP (BP) said late Monday that it had made a $3 billion deposit into the $20 billion escrow account, from which the oil giant will pay for claims to those who suffered from the effects of the Gulf Coast oil spill. Shares of BP were down 1.2% in pre-market trading.

Walt Disney Co. (DIS, Fortune 500) is expected to report a fiscal third-quarter earnings after the bell. Analysts polled by Thomson Reuters expect the media giant earned 58 cents per share, up 12% from a year ago, on revenues of $9.4 billion.

World markets: European markets fell back in the early going. Britain's FTSE 100 was down 0.7% in morning trading. France's CAC 40 and Germany's DAX posted declines of about 1%.

In Asia, Chinese shares led declines, following a report that showed Chinese imports slowed in July, increasing only 22.7% from a year earlier, compared to a 34.1% year-over-year jump the prior month.

The Shanghai Composite finished the session down 2.9%. The Hang Seng in Hong Kong lost 1.5% and Japan's Nikkei slipped 0.2%.

Currencies and commodities: The dollar gained against the euro and U.K. pound, but was flat versus the Japanese yen.

Oil futures for September delivery fell $1.30 to $80.18 a barrel.

Gold futures for December delivery slipped $6.70 to $1,1985.90 an ounce.

Bonds: Prices for Treasurys were a little higher. The yield on the 10-year note was 2.81%. The government is scheduled to auction $74 billion worth of debt this week, beginning with $34 billion worth of 3-year notes on Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |