Search News

Click chart to track futures.

Click chart to track futures.

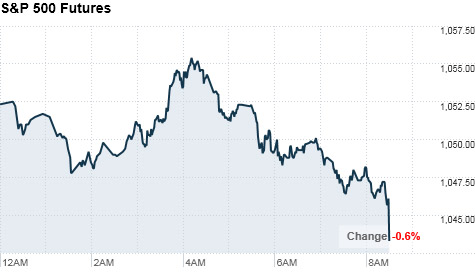

NEW YORK (CNNMoney.com) -- Stocks were set for a weak open Wednesday, as investors remained wary ahead of more news from the housing market. On Tuesday, a report showing the sales of existing homes plunged 27% in July sparked a big selloff in U.S. markets.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures turned slightly, after holding above breakeven earlier in the morning. Futures measure current index values against perceived future performance.

"The market is being driven by economic fundementals, and things aren't looking to rosy." said Len Blum, managing director at Westwood Capital LLC. "There's not much upside for the market right now, and there won't be until we see some positive economic news."

Blum said investors will be focused on the strength of consumers, since their spending accounts for 70% of economic activity.

"Recent data shows that consumers have been really damaged and are still hurting, and we can't have a recovery without them," he said.

Stocks tumbled Tuesday after a worse-than-expected plunge in existing home sales fueled worries that the economy may relapse. The Dow ended the day down 134 points.

Economy: A government report showed that new orders for long-lasting goods rose 0.3% in July, following a 1% drop in June. Durable orders were forecasted to climb 3% during the month, according to economists surveyed by Briefing.com.

A separate government report due after the opening bell is expected to show that sales of newly built homes rose in July, to an annual rate of 334,000 units from 330,000 units the month before.

On Tuesday, the National Association of Realtors reported a sharp drop in existing home sales, which are considered the core of the residential real estate market.

Companies:Toll Brothers (TOL) surprised analysts by posting its first quarterly profit in three years as revenue declined less than expected. The company said its net income was $27.3 million, or 16 cents per share, compared to a loss of $472.3 million, or $2.93 a share, a year earlier.

The homebuilder is the first to report results following the expiration of the homebuyer tax credit, which helped boost the housing market. Shares of Toll Brothers fell 1.1% in premarket trading.

World markets: European shares were under pressure in early trading. The CAC 40 in France and Britain's FTSE 100 fell 0.7%, while the DAX in Germany lost 0.3%.

Investors digested Standard & Poor's slashed rating of Ireland's sovereign debt. The agency cut Ireland's rating by a notch to double-A-minus, citing the massive cost of patching up the hemorrhaging Irish banking system.

Investors digested Standard & Poor's slashed rating of Ireland's sovereign debt. The agency cut Ireland's rating by a notch to double-A-minus, citing the massive cost of patching up the hemorrhaging Irish banking system.

Asian markets ended lower. Japan's benchmark Nikkei index dropped 1.7%, hitting a 16-month low. The Hang Seng in Hong Kong shed 0.1%, and the Shanghai Composite sank more than 2%.

Currencies and commodities: The dollar firmed against the euro, the British pound and the Japanese yen.

Oil futures for October delivery slipped 6 cents to $71.57 a barrel. The government's weekly oil inventory report comes out after the market opens.

Gold for December delivery rose $3.00 to $1,1236.40 an ounce.

Bonds: Prices for Treasurys were mostly higher. The yield on the 10-year note edged down to 2.49% from 2.50% late Tuesday. Bond prices and yields move in opposite direction. The U.S. will offer $36-billion in 5-year notes Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |