Search News

NEW YORK (CNNMoney.com) -- U.S. stocks were set to open higher Friday, as investors mulled over strong earnings reports and currency tensions at a summit of the world's major economies.

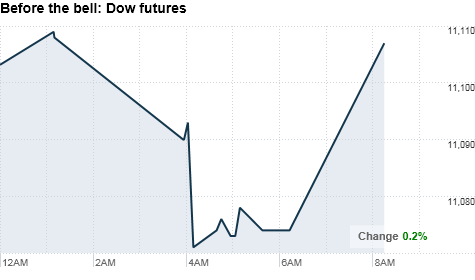

After hovering around breakeven, Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures turned higher about an hour before the opening bell Friday. Futures measure current index values against perceived future performance.

Stocks are coming off gains Thursday, as investors balanced strong earnings with heightened speculation that the Fed's next round of asset-buying won't be as dramatic as anticipated.

The two-day Group of 20 finance and central bank meeting kicked off Friday in South Korea, with tensions about a so-called currency war brewing.

In a widely reported letter to the G-20 nations, U.S. Treasury Secretary Timothy Geithner urged some developing countries to stop keeping their currencies artificially low, and cap their surpluses or deficits to rebalance the world economy.

"You have Geithner talking about the importance of the strength of the U.S. dollar; others talking about what they're going to do to avoid a currency war. It has some below-the-fold influence on markets," said Mark Luschini, chief investment strategist with Janney Montgomery Scott.

"This is a lot of rhetoric leading into what will be talked about this weekend, but nothing really matters until we see a formal announcement come out early next week," he added.

U.S. officials have been pushing China to allow its currency, the yuan, to rise against the dollar and level the international export playing field.

Companies: After Friday's market close, Amazon (AMZN, Fortune 500) posted a 39% jump in sales and third-quarter earnings per share of 51 cents -- topping the 48 cents expected by analysts. But the stock fell 3.6% in premarket trading Friday.

Shares of AIG (AIG, Fortune 500) rose 1.5% in premarket trading, after reports said the insurance giant sold its Asian life unit for $17.8 billion in a share offering.

AIG has said that it considers the sale of AIA -- one of it's crown jewels -- to be a crucial component of its effort to repay the bailout it took from the U.S. government.

KeyCorp (KEY, Fortune 500) shares rose 3.5% after the the Ohio bank announced its third-quarter income rose to $163 million. The company posted a $422 million loss in the same quarter last year.

Honeywell (HON, Fortune 500) reported third-quarter sales rose to $8.4 billion, but earnings declined. Shares rose 0.2% in premarket trading.

Shares of Schlumberger (SLB) rose 1.5%, after the oilfield services company reported a rise in both third-quarter profit and revenue.

Shares of Verizon (VZ, Fortune 500) fell 0.5% after the company reported third-quarter earnings per share of 31 cents, down from 41 cents per share a year earlier. The results included 25 cents per share in non-operational charges, much of which was related to pension settlements.

World markets: European stocks were mixed in midday trading. Britain's FTSE 100 fell 0.2%. The DAX in Germany and France's CAC 40 both rose about 0.1%.

Asian markets ended the session mixed. The Shanghai Composite fell 0.3%, while the Hang Seng in Hong Kong fell 0.6%. Japan's Nikkei rose 0.5%.

Currencies and commodities: The dollar fell against the euro, the British pound and the Japanese yen.

Oil for December delivery rose 89 cents to $81.45 a barrel.

Gold futures for December delivery fell 80 cents to $1,325 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield down to 2.58%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |