Search News

Click chart for more premarkets data.

Click chart for more premarkets data.

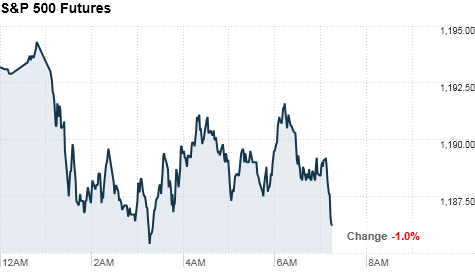

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to open lower Tuesday, as world markets reacted to an exchange of artillery fire between North and South Korea.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures fell ahead of the opening bell, following the global sell-off started by Asian markets and ongoing in Europe. Futures measure current index values against perceived future performance.

Markets will decline as a result of the artillery exchange, said Robert Brusca, chief economist at Fact and Opinion Economics, but damage will be limited because erratic behavior by North Korea is expected.

Investors will start the trading session with positive piece of economic news, after a government report said the economy grew at 2.5% annual rate in the third quarter, faster than the 2% rate previously reported.

Stocks ended mixed Monday, as weakness in the banking sector overshadowed news that Ireland would accept financial assistance.

Investors had been on edge recently about Ireland's long-term debt problems. But over the weekend, the nation's prime minister formally requested substantial financial assistance from the European Union and the International Monetary Fund.

Shares of big banks came under pressure late Monday, after federal law enforcement officials searched the offices of three prominent hedge funds, in what is said to be a large-scale insider trading probe.

Trading could be choppy this week, with many market participants taking time off ahead of the Thanksgiving holiday. All U.S. markets will be closed Thursday.

"This is like a lost week," Brusca said. "Traders won't be taking big positions, unless something really big happens and then they will have to pick up the cell phone and call the boss."

World markets: European stocks were lower at midday. Britain's FTSE 100 dropped 0.7%, the DAX in Germany slipped 0.3% and France's CAC 40 lost 1.0%

Asian markets ended lower, after North Korea attacked a South Korean island. South Korea's Kospi index lost 0.7%. The Shanghai Composite lost 1.9% and the Hang Seng in Hong Kong dropped 2.7%. Japan's market was closed for a holiday.

Economy: The U.S. economy grew at a better than expected 2.5% annual rate in the third quarter, faster than 2% rate previously reported, the government said before the opening bell.

The National Association of Realtors is scheduled to report on October existing home sales after the market opens. Economists expect the report to show sales fell to an annual rate of 4.42 million in the month, from 4.53 million in September.

Later in the day, the Federal Reserve is due to release the minutes from its Nov. 3 policy meeting of the central bank's open markets committee.

Companies: Hewlett-Packard (HPQ, Fortune 500) reported late Monday that quarterly profits and sales topped Wall Street's forecasts, on the back of strong PC and server sales.

The company said it also expects sales and earnings to be above analysts' expectations in the current quarter. HP shares were up in premarket trading.

Clothing retailer J. Crew (JCG) is in talks for a $2.8 billion sale to buyout firms TPG Capital and Leonard Green & Partners, the New York Times reported late Monday. Shares of J. Crew were sharply higher in premarket trading.

Blackstone Group's pursuit of electric power provider Dynegy (DYN) has come to an end after activist shareholders objected to the takeover, Dynegy said in a statement.

Currencies and commodities: The dollar strengthened against the euro, the Japanese yen and the British pound.

Oil for January delivery slipped $1.38 to $80.36 a barrel.

Gold futures for December delivery rose $1.10 to $1,358.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.77% from 2.81% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |