Search News

Click on the chart to see other futures data.

Click on the chart to see other futures data.

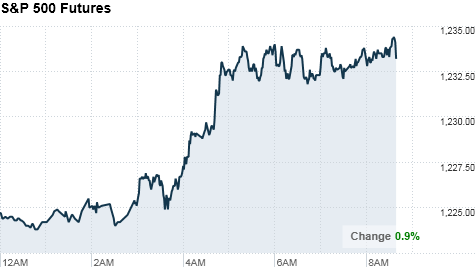

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to open higher Tuesday, after President Barack Obama announced a compromise with Republican lawmakers that would extend the Bush-era tax cuts for 2 years.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up nearly 1% ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks had climbed more than 2% last week as investors hoped for a deal that would extend current tax rates.

Late Monday, President Obama announced a deal with Republican leaders that would extend Bush-era tax cuts for 2 years and unemployment benefits for 13 months. It would also lower the payroll tax by 2 percentage points for a year.

"What that does is it removes uncertainty from businesses, from individuals, other entities as far as the taxes for 2011 and 2012 and also all the taxes would stay as they were," said Zahid Siddique, Associate Portfolio Manager of the Gabelli Equity Trust. "Assuming that we have a resolution, it is something that markets would like."

On Monday, major indexes ended mixed after drifting around breakeven for most of the day. Investors spent most of the day mulling over Federal Reserve chairman Ben Bernanke's pessimistic comments about the nation's economy.

While stock investors sat on the sidelines, commodities surged Monday. That rally continued Tuesday morning with gold hitting a fresh intraday high, oil topping $90 a barrel for the first time in more than 2 years, and silver prices hitting another 30-year high.

Commodities have been on a tear as investors see increased demand from countries like China. They're also being used a hedge against inflation and moving higher on the back of the weakening dollar, said Siddique. "As the dollar weakens, that means the commodities will move higher because they are linked to the dollar."

Currencies and commodities: The dollar fell against the euro and the British pound, but rallied against the Japanese yen.

Oil for January delivery gained $1.19 to $90.58 a barrel, crossing the $90 a barrel threshold for the first time since October 2008. Oil for January delivery settled at a new 2-year high Monday, at $89.38 a barrel.

Gold futures for February delivery rose $14.40 to $1,430.50 an ounce, after reaching a new intraday high of $1,432.50 earlier in the session. Gold settled at a record $1,416.10 an ounce Monday.

Silver for March delivery rose 95 cents, or 3.2%, to $30.68 an ounce. Earlier in the session, silver topped $30.75 an ounce -- a new 30-year high.

World markets: European stocks jumped in morning trading. Britain's FTSE 100 added 1.3%, the DAX in Germany gained 1.1% and France's CAC 40 surged 2%.

Investors are keeping close tabs for any statements from European finance ministers about Spain and Portugal. There had been widespread speculation that the two countries would need a bailout but that talk has been tempered and investors see that as a good sign for Europe's debt problems, said Siddique.

Asian markets ended the session mixed. The Shanghai Composite added 0.7% and the Hang Seng in Hong Kong jumped 0.8%, while Japan's Nikkei shaved 0.3%.

Companies: AGL Resources (AGL) and Nicor Inc. (GAS) announced a merger creating a leading U.S. natural gas distribution company. The combined company will be known as AGL Resources. Shares of AGL were down 3.5% in premarket trade, while shares of Nicor rallied 6%.

Economy: A report on consumer credit Tuesday afternoon is forecast to show a decline of $2.5 billion in October, following a gain of $2.1 billion in the previous month.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.03%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |