Click on the chart to see other futures data.

Click on the chart to see other futures data.

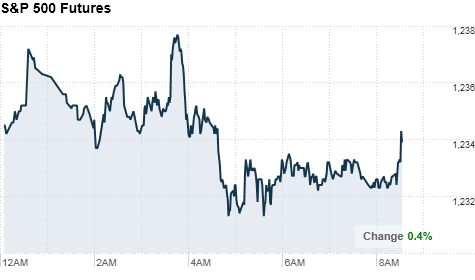

NEW YORK�(CNNMoney.com) -- U.S. stocks were poised to open higher, after slightly better-than-expected data on the the number of Americans filing for first-time unemployment benefits.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were modestly higher ahead of the opening bell. Futures measure current index values against perceived future performance.

On Wednesday, stocks managed to eke out gains as a rebound in bank shares offset weakness in commodities, and concerns about rising interest rates in the Treasury market.

Investors are already putting 2010 behind them. "The economic calendar has been really thin so the market has been looking ahead to 2011," said Scott Brown, chief economist at Raymond James. "I think the real debate is the strength of the economy in 2011."

Most economists agree the economy will continue to grow next year, but the pace won't necessarily be strong enough to push the unemployment rate lower, said Brown. Just last week, the government reported that the unemployment rate rose to 9.8% in November.

Initial unemployment claims help give a read on the labor market. "But this time of year it tends to be pretty choppy, and that is due to difficulties in the seasonal adjustments," said Brown. "The numbers can really jump around week to week." He said the focus should remain on the four-week moving average, rather than the weekly gains or losses.

The tax deal that President Obama struck with key Republicans has been top of mind for markets, too. When the deal was initially announced, markets surged. But as signs of opposition emerged, investors stepped back a bit.

Economy: The number of people filing for initial jobless claims fell 17,000 to 421,000 in the latest week from 436,000 the previous week, the Labor Department said in its most weekly jobless claims report. Economists had expected the number to decrease to 429,000.

After the opening bell, the Commerce Department will release a report on wholesale inventories that is expected to show inventories fell to 0.7%, from 1.5% in October.

Companies: Howard Stern announced that he has re-signed with SiriusXM (SIRI) Radio for five years, sending Sirius' stock surging 9% in premarket trade.

Tech giant Dell (DELL, Fortune 500) made a bid for Compellent Technologies Inc. (CML) for $27.50 a share -- well below the $33.65 per share the data storage company closed at on Wednesday. Dell and rival HP (HP) were in an intense bidding war over another data storage company, 3PAR (PAR), recently. HP ended up acquiring 3PAR, so Dell's move to take Compellent could be Dell's reaction to losing the bidding war. Shares of Compellent plunged 16% in premarket trade, while shares of Dell rose less than 1% on the news.

After the market close, Green Mountain Coffee (GMCR) is expected to report an earnings per share of 20 cents, down from the 34 cents per share it reported a year ago.

On Wednesday, the corporate websites of Visa and MasterCard appeared to be under cyberattack by purported Wikileaks backers. Shares of Visa and MasterCard were little changed.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 rose 0.3%, the DAX in Germany dipped 0.1% and France's CAC 40 rose 0.6%.

Asian markets also ended the session mixed. The Shanghai Composite shaved 1.3%, the Hang Seng in Hong Kong added 0.3% and Japan's Nikkei gained 0.5%.

Currencies and commodities: The dollar rallied against the euro and the British pound, but fell slightly against the Japanese yen.

Oil for January delivery gained 62 cents to $88.90 a barrel.

Gold futures for February delivery edged up $4.30 to $1,387.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury note rose slightly, pushing the yield down to 3.21%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |