Click on the chart to see other futures data.

Click on the chart to see other futures data.

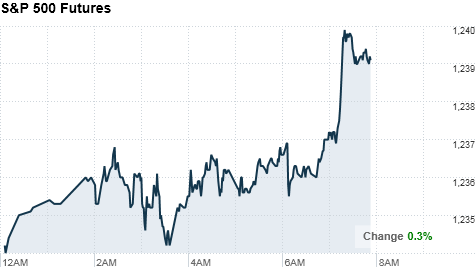

NEW YORK�(CNNMoney.com) -- U.S. stocks were poised to open slightly higher Monday, as investors mull over a slew of corporate deals, and await resolution on the tax-cut deal from Washington

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all up modestly ahead of the opening bell. Futures measure current index values against perceived future performance.

On Friday, the S&P 500 closed at a two-year high, as stocks advanced on upbeat economic news and a dividend hike by General Electric.

Investors have been on tenderhooks about the next steps Washington might take. Resistance from House Democrats is threatening to stymie a deal the White House struck with Republican leaders to extend Bush-era tax cuts.

"Each step along the way will be reassuring, but especially as the end of the year looms, I think people will be watching pretty closely to see if they can in fact push that over the final goal line," said Bruce McCain, chief investment strategist at Key Private Bank. "If it bogged down in a stalemate, if gridlock took effect, I think that might be pretty discouraging for investors."

McCain does expect that there are enough conservative Democrats on board with the compromise to get the deal passed.

World markets: Asian markets ended the session higher. The Shanghai Composite surged 2.9%, the Hang Seng in Hong Kong added 0.7% and Japan's Nikkei rose 0.8%.

China's economy has been booming, fueling fears of an imminent interest rate hike. There has been wide speculation for several weeks that China's government would raise interest rates to slow the economic growth. So far, that rate hike has yet to be announced.

"The big issue with China is simply that we have not seen a material slowing in their growth rate but with each policy they make to quell inflation, it may slow growth," said McCain.

China's growth impacts the U.S. recovery because the U.S. recovery has thus far depended on exports. Investors will be paying close attention to China in the coming months, not just during the short term, he said.

Meanwhile, Chinese consumer prices rose 5.1% for the 12 months ended Nov. 30, according to government data released early Saturday in China. That comes on the heels of a 4.4% jump in October. And once again, a surge in food costs is the culprit. Food prices rose 11.7% during the period.

European stocks were also higher in morning trading. Britain's FTSE 100 ticked up 1%, the DAX in Germany edged up 0.4% and France's CAC 40 added 0.9%.

Economy: No major economic reports are scheduled to be released Monday. However, a raft of reports on unemployment, consumer prices and new home construction will be released later in the week.

In addition, the Federal Reserve will release its scheduled policy statement Tuesday.

Readings on inflation are due out over the next couple days, which McCain said will be more interesting to investor's than "anything the Fed might say about what it hopes to accomplish."

Some market watchers are concerned that the Fed's moves to stimulate the economy will have a damaging effect on the value of the dollar. But McCain said higher numbers for the CPI or PPI this week "could have a more profound impact."

Companies: Investors have a slew of corporate deals to chew on.

General Electric (GE, Fortune 500) offered $1.3 billion for Wellstream Holdings PLC (WSM), an engineer and manufacturer of products for oil and gas transportation in the subsea production industry. Shares of GE edged higher in premarket trading.

Thermo Fisher Scientific (TMO, Fortune 500), the parent company of Thermo Scientific and Fisher Scientific, announced that it would acquireDionex Corporation (DNEX), a leading manufacturer and marketer of chromatography systems, for about $2.1 billion, or $118.50 per share in cash. Thermo Fisher's offer represents a 21% premium to Dionex's closing stock price on Dec. 10.

Also, Dell (DELL, Fortune 500) announced that it has purchased data storage company Compellent Technologies, Inc. (CML) for $27.75 per share in cash. Last Thursday, Dell announced it was in talks with Compellant about a potential deal. Shares of Dell fell 1.4% in premarket trade, while shares of Compellent slid nearly 2% in premarket trade.

Currencies and commodities: The dollar was up against the Japanese yen and the British pound, but lost ground against the euro.

Oil for January delivery gained $1.28 cents to $89.07 a barrel.

Gold futures for February delivery rose $8.20 to $1,393.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged down slightly, pushing the yield up to 3.38%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |