Search News

Click on the chart to see other futures data.

Click on the chart to see other futures data.

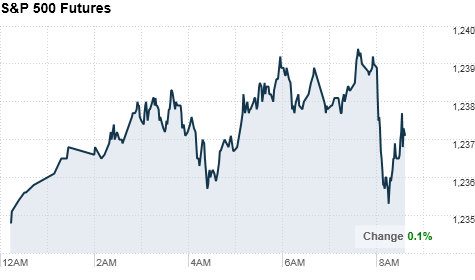

NEW YORK (CNNMoney.com) -- U.S. stocks were set to open almost flat Tuesday amid of a slew of economic data, and as investors continue to await resolution on a tax cut deal in Washington.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all slightly higher ahead of the opening bell, after being mixed throughout the morning. Futures measure current index values against perceived future performance.

On Monday, stocks finished a lackluster session mixed as investors mulled a flurry of corporate deals, and as the tax deal cleared a key Senate procedural hurdle.

Markets were unable to carry over last week's momentum, when stocks climbed, with the S&P 500 reaching its highest level in two years on Friday.

Investors are largely counting on the extension of the Bush-era tax cuts. The compromise between President Obama and Republicans in Congress could face a final Senate vote Tuesday after passing a key test Monday.

"It has largely been anticipated at this time but I think you will get a little bit of a euphoric bounce when it actually passes the House," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. "If nothing else, maybe a source-of-relief rally that it wasn't stalled out."

An extension of the Bush-era tax cuts would keep cash in the wallets of Americans. And since consumers are responsible for the lion's share of spending in the U.S., confident consumers willing to spend is key to an economic recovery.

Any reports that take "a litmus test of the consumer" will be top of mind for investors between now and the end of the holiday shopping season, said Luschini.

Economy: The Federal Reserve's policy statement is due at 2:15 p.m. ET. The central bank is widely expected to hold interest rates near 0%, where they have been since the financial crisis took hold in 2008.

"I am expecting that we don't hear much in the way of new language," said Luschini. Investors will be keeping a close eye for any update on the Fed's read on the health of the economy or the Fed's quantitative easing program.

Government reports on retail sales and inflation at the wholesale level were released before the market opened.

A report on retail sales was better than expected on the strength in gasoline prices and clothing sales: U.S. retail sales rose 0.8% in November the Commerce Department said, better than the 0.5% that economists were expecting, according to consensus estimates from Briefing.com. Excluding the automotive sector, sales popped 1.2%, more than the 0.6% increase economists had been expecting.

Also, out before the opening bell, the producer price index for November increased 0.8% in November, more than the 0.5% gain that was expected. Core PPI -- which excludes food and energy prices -- rose 0.3%, a larger increase than the 0.2% expected increase.

After the market opens, another report is expected to show business inventories grew 1.1% in October.

Companies: BestBuy (BBY, Fortune 500) shares slid 12% in premarket trading after the home electronics retailer lowered its fiscal year outlook and posted a 3.3% decline in quarterly same-store sales.

Homebuilder Hovananian (HOV) reports after the closing bell.

World markets: European stocks were little changed in morning trading. Britain's FTSE 100 rose 0.2%, the DAX in Germany slid 0.1% and France's CAC 40 dropped less than 0.1%.

Asian markets ended higher. The Shanghai Composite added 0.1%, the Hang Seng in Hong Kong gained 0.5%, and Japan's Nikkei rose 0.2%.

Currencies and commodities: The dollar slid against the euro and the Japanese yen, and gained slightly on the British pound.

Oil for January delivery shaved 1 cent to $88.45 a barrel.

Gold futures for February delivery rose 60 cents to $1,398.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged down slightly, pushing the yield up to 3.31%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |