Search News

Click on the chart to see other futures data.

Click on the chart to see other futures data.

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to open lower Wednesday as worries about European debt underpinned sentiment, with Spain being the latest country to face a possible downgrade.

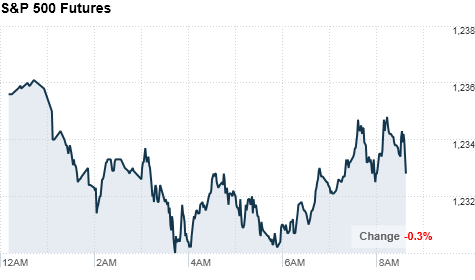

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down about 0.2% to 0.3% ahead of the opening bell. Futures measure current index values against perceived future performance.

On Tuesday, U.S. stocks eased off earlier gains but finished higher. Investors found little reason to jump into the fray, after the Federal Reserve kept rates steady and left its bond-buying plan alone. The Fed stated in its report that "progress toward its objectives has been disappointingly slow."

The Fed's announcement was largely expected. "It goes back to Bernanke's interview a couple Sundays ago," said Michael Gault, senior portfolio strategist at Weiser Capital Management. "He has really been pounding his fist saying that unemployment is the number one priority right now."

The Fed will continue to keep rates low and pursue its quantitative easing program until "the country can stand on its own," Gault explained.

Stocks have been on a pretty solid run. All three major indexes have gained about 5% this month, and are up more than 6% for the quarter. Stocks are on track for double-digit percentage gains for the year.

Additionally, investors have been waiting for Congress to extend the Bush-era tax cuts. While market watchers expect the deal to pass, the waiting has had investors slightly on edge. The compromise passed a key test Monday, and is expected to get Senate approval later Wednesday.

Economy: Consumer prices rose at a seasonally adjusted 1.1% on an annual basis, the Labor Department said Wednesday. The Consumer Price Index -- the government's main inflation gauge --increased 0.1% in November, slightly less than the 0.2% rise economists were expecting. Meanwhile, the core CPI -- excluding food and energy -- increased 0.1% in November, in line with expectations.

A monthly survey of manufacturers in New York State from the Federal Reserve Bank of New York showed that conditions improved in December, for New York State manufacturers.

While investors will look for any major outliers in the economic reports due out Wednesday, Gault says the government's update on the unemployment filings due Thursday is more interesting. "Investors are focused on jobs week in, week out," he said.

Also, the report on housing starts due out Thursday will get some attention.

World markets: European stocks were lower in morning trading. Britain's FTSE 100 fell 0.3%, the DAX in Germany shed 0.6% and France's CAC 40 lost 0.8%.

Moody's said it may downgrade Spain's local and foreign currency government bond ratings. The ratings agency cited Spain's high refinancing needs in 2011, fragile market confidence, and central government's limited control over the regional governments' finances, among the reasons for putting Spain's ratings under review.

The rating review for Spain "is going to affect markets -- and it is going to affect them to the downside -- but it is going to be modest," Gault said. At this point, it is not clear how deep Spain's debt problems are and whether it would need any support from the EU. But "investors expect that if it comes that Spain needs it, that it will be there," Gault said.

Asian markets ended lower. The Shanghai Composite gave up 0.5%, the Hang Seng in Hong Kong plunged 2%, and Japan's Nikkei shaved 0.1%.

Companies: Switzerland-based Novartis announced a deal to buy the remainder of eye care company Alcon (ACL) for $12.9 billion. Shares of Alcon were up more than 2% in premarket trade.

Currencies and commodities: The dollar gained against the euro, the Japanese yen and the British pound.

Oil for January delivery slipped $1.03 to $87.25 a barrel.

Gold futures for February delivery fell $10 to $1,387.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury ticked higher, pushing the yield down to 3.43%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |