Search News

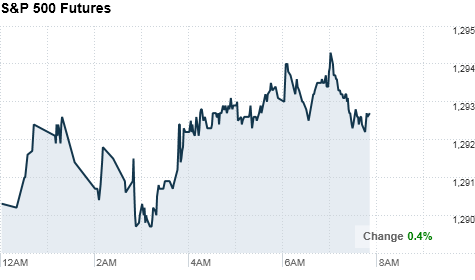

Click chart for more pre-market action.

Click chart for more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks were poised for a higher open Wednesday, as investors await the Federal Reserve's latest pronouncement on the nation's economy, new home sales data and corporate results.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks have been on a tear in recent weeks, with the Dow approaching the 12,000 mark -- a level last seen in June 2008. On Tuesday, the index finished just 23 points shy of the barrier.

On Tuesday, stocks closed mixed after staging a late comeback, as investors digested results from a host of blue-chip companies, mixed reports on the U.S. economy and surprisingly slow growth in the United Kingdom.

"Stocks continue to rally, even on days where it looks like we're going to finish down -- the market seems to will itself to flat or positive on days when it shouldn't," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

While stocks may continue their run-up in the next couple weeks, the market is due for a correction, he added.

"Earnings reports are driving investors' attitudes at the moment, and we have sort of an uneven reporting season," he said. "On balance they're not bad, but they're not as good as we had been seeing. So I think we're susceptible to an entrenchment in equity prices, even if it's because we're meeting expectations rather than beating them."

Optimism sparked from President Obama's State of the Union address late Tuesday may also help push stocks higher.

"He kind of reached out with an olive branch to the business community," Luschini said. "He recognized that we need to cooperate with businesses to foster a more profitable environment, that they are encouraged to invest in and urged Congress to look at corporate taxes in an urgent fashion."

Economy: The Federal Reserve is expected to hold its benchmark interest rate near rock-bottom, when it concludes a two-day meeting Wednesday. A policy statement is expected around 2:15 p.m. ET.

New home sales data will be released by the Commerce Department after the market opens. Economists expect sales rose to an annual rate of 300,000 in December from 290,000 in November, according to a consensus of estimates from Briefing.com.

Companies: Toyota (TM) announced it is recalling more than 1.5 million vehicles worldwide for issues that could result in fuel leakage. News of the recall sent shares of the automaker more than 1% lower in premarket trading.

Xerox (XRX, Fortune 500) logged earnings that fell from a year earlier, but were in line with expectations and announced its Chief Financial Officer Larry Zimmerman will retire next month. Shares of Xerox dropped more than 3% following the report.

Dow component United Technologies (UTX, Fortune 500) posted a quarterly profit that also slightly beat forecasts. Shares of the company edged about 1% lower. Boeing (BA, Fortune 500)'s lower quarterly profit also met expectations, but its revenue and outlook disappointed -- pushing shares of the company down 2.4%.

US Airways (LCC, Fortune 500) posted its first quarterly profit since 2006 and widely beat Wall Street forecasts, lifting shares of the airline by more than 4% ahead of the bell.

ConocoPhillips (COP, Fortune 500) is also scheduled to release quarterly financial statements before the market opens. Analysts surveyed by Thomson Reuters expect ConocoPhillips to report earnings per share of $1.32 on revenue of $46.20 billion.

Shares of Yahoo (YHOO, Fortune 500) slipped 2% in pre-market trading, after the company reported quarterly results late Tuesday that missed expectations.

After the market close Wednesday, coffee chain Starbucks (SBUX, Fortune 500) is slated to report its quarterly earnings.

World markets: European stocks jumped in midday trading. Britain's FTSE 100 climbed 1.3%, the DAX in Germany surged 1.2% and France's CAC 40 rose 1%.

Asian markets ended mixed. The Shanghai Composite gained 1.2% and the Hang Seng in Hong Kong edged up 0.2%, while Japan's Nikkei slipped 0.6%.

Currencies and commodities: The dollar lost ground against the euro and the British pound, but rose slightly against the Japanese yen.

Oil for March delivery edged up 59 cents to $86.78 a barrel.

Gold futures for February delivery fell $1.10 to $1,331.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.38% from 3.32% late Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |