Search News

Click on chart for more premarket action

Click on chart for more premarket action

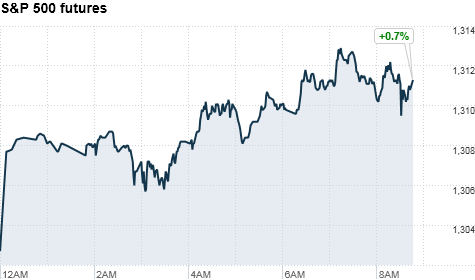

NEW YORK (CNNMoney) -- U.S. stocks were set for a higher open Friday, as oil prices slipped. However, futures backed off slightly from earlier highs after a disappointing report on the health of the U.S. economy.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

On Thursday, stocks rebounded from afternoon lows and finished with small losses, as oil prices retreated from two-year highs above $100 a barrel.

"You might get a little bit of a relief rally, because oil prices are hovering around the $96 to $97 [per barrel] range," said Peter Cardillo, chief market economist for Avalon Partners. "We're looking at stable commodity prices."

All three major indexes are on track for their worst week since August. Despite the pullback, stocks are still higher for the month of February and the year.

The Dow has posted losses for three consecutive sessions, losing 285 points this week, or 2.5%. Monday and Tuesday's plunges were the first back-to-back triple-digit declines since June.

"We've seen a pullback in oil prices and there seems to be a direct correlation in the last couple days between stock prices and oil prices," said Mark Luschini, chief investment strategist for Janney Montgomery Scott.

The biggest catalyst for even higher oil prices would be "if turmoil in the Middle East pours into another more strategic country, like Saudi Arabia," he said.

Economy: The U.S. Bureau of Economic Analysis reported the real gross domestic product increased at an annual rate of 2.8% in the fourth quarter. This is a revision from a preliminary report.

The GDP revision was much less than 3.3% increase economists forecasted, according to a consensus surveyed by Briefing.com.

A final read on February's University of Michigan consumer sentiment survey also is on the docket. The index is expected to remain unchanged at 75.1.

Companies: Shares of Boeing (BA, Fortune 500) were 4% higher in premarket trading, after the aerospace company won a $35 billion contract from the Air Force late Thursday.

Bailed-out insurer AIG (AIG, Fortune 500) posted an $11 billion profit for the fourth quarter, and $10 billion in earnings for the full year. Shares were up slightly in premarkets.

JC Penney (JCP, Fortune 500) reported a 30% surge in quarterly earnings, to $1.09 per share. The retailer beat analysts' forecast, who were expecting the department store chain to earn $1.08 a share. The company attributed the increase to the launch of "exclusive brands," like Liz Claiborne.

World markets: European stocks rose in morning trading. Britain's FTSE 100 edged higher 1%, the DAX in Germany ticked up 0.5% and France's CAC 40 gained 1.5%.

Asian markets ended the session mostly higher. The Shanghai Composite was flat, while the Hang Seng in Hong Kong rose 1.8% and Japan's Nikkei added 0.7%.

Currencies and commodities: The dollar gained strength against the euro and the British pound but slipped against the Japanese yen.

Oil for April delivery fell 74 cents, or less than 1%, to $96.54 a barrel.

Motorists are feeling the spike. The nationwide average price for gasoline rose nearly 6 cents overnight, according to AAA. This means that prices have jumped nearly 12 cents this week.

Gold futures for April delivery dipped $10.20, or about 0.8%, to $1,405.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.46% from 3.42% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |