Search News

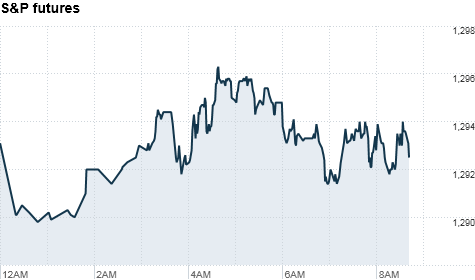

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were headed for a flat open Tuesday as investors took a step back from the previous session's rally. They also considered a more than 4% boost in Tokyo's Nikkei index as the nuclear situation in Japan continued to show signs of improvement.

Dow Jones industrial average (INDU) futures were up less than 0.1%, while Nasdaq (COMP) futures added 0.3%. The S&P 500 (SPX) was little changed ahead of the opening bell. Futures measure current index values against perceived future performance.

U.S. stocks rallied for a third straight session Monday, as Japan made progress in cooling its nuclear reactors and investors cheered AT&T's (T, Fortune 500) $39 billion deal to acquire T-Mobile.

The Dow finished Monday's session above the 12,000-point mark for the first time since the Japanese earthquake on March 11.

"There's nothing like the early days of nation-rebuilding to get people excited," said Tom Winmill, portfolio manager at Midas Fund. "Any good news in Japan is going to tempt investors back into the markets."

The Japanese stock market was closed Monday for a national holiday. On Tuesday, the Nikkei soared 4.4%.

In the two full trading days following the earthquake and tsunami, the Nikkei plunged 16% and the yen soared. But the G7 intervention in the currency markets, along with modest signs that Japan has gotten its nuclear reactors under control, have helped bolster sentiment.

In other Asian markets, the Shanghai Composite added 0.3%, while the Hang Seng in Hong Kong gained 0.8%.

European stocks were mixed in afternoon trading. Britain's FTSE 100 gained 0.2% and the DAX in Germany ticked down 0.2%. France's CAC 40 gained 0.2%.

Meanwhile, turmoil in Libya continued to escalate. The United States and its allies launched an air strike on Monday, which pushed oil prices above $103 a barrel.

Though investors' overall focus is "99% geopolitical," Winmill said tensions in Libya and the Middle East "are taking something of a backseat to Japan today."

Oil for April delivery slipped 63 cents, or 0.6%, to $101.70 a barrel. May delivery will become the front-month contract after the close of trade, and it's already the most active contract, falling 62 cents, or 0.6%, to $102.47.

Economy: Investors don't have much to look at in the way of economic data Tuesday, with the Federal Housing Finance Agency's home price index the only report on deck.

Companies: After the close of trade, software maker Adobe Systems (ADBE) and credit card company Discover (DIS, Fortune 500) are on tap to report results.

Late Monday, news reports revealed that Apple had sued Amazon in California federal court. In the complaint, Apple asked a judge to block Amazon from using the term "Appstore." Three years ago, Apple was granted a trademark on its own "App Store."

Shares of Bristol-Myers Squibb (BMY, Fortune 500) were up nearly 5% on heavy volume after the company said it's experimental drug ipilimumab extended survival of previously untreated patients with melanoma in a late stage study.

Currencies and commodities: The dollar was slightly lower against the euro and the British pound, and flat versus the Japanese yen.

Gold futures for April delivery fell $1.10, or 0.1%, to $1,425.30 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was unchanged, holding the yield at 3.32%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |