Search News

Click the chart for more market data.

Click the chart for more market data.

NEW YORK (CNNMoney) -- Stocks posted gains Friday to finish their best month this year, as investors got a confidence boost from strong earnings out of Caterpillar.

"The market feels a little on the high side, but these good earnings figures are keeping stocks slowly moving higher," said Frank Davis, director of sales and trading at LEK Securities.

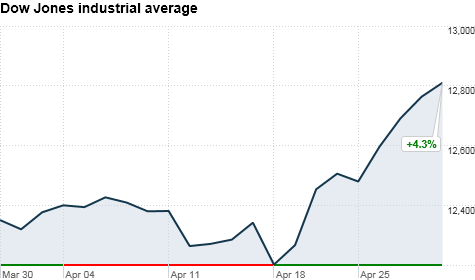

The Dow Jones industrial average (INDU) rose 47 points, 0.4%, to finish at 12,811, closing at a fresh multi-year high. The Dow ended the week up 2.4% and finished the month with a gain of 4.3%.

Economic bellwhether Caterpillar (CAT, Fortune 500) helped lift the Dow, after the company said its bottom line got a boost due to strong demand for bulldozers and other heavy machinery. Shares closed up 2.5%.

The S&P 500 (SPX) closed up 3 points, or 0.2%, to end at 1,365. The index finished the week up 2% and the month with a gain of 3.3%. The Nasdaq Composite (COMP) rose 1 point, or less than 0.1%, to 2,874, closing up 1.9% for the week and adding 4.2% in April.

The tech-heavy Nasdaq was weighed down by shares of Research in Motion (RIMM), which plummeted 14% after the BlackBerry maker warned of weaker sales.

Investors remain nervous about the economy and inflation. The Fed has been pretty clear that interest rates aren't likely to budge this year. Meanwhile, gold and silver continue to hit new highs as the U.S. dollar keeps sliding, falling to a three-year low against the euro.

Despite the nervousness, April was the best month for the three indexes since December.

On Thursday, U.S. stocks rose to multi-year highs, as investors looked beyond a series of mixed earnings reports and disappointing GDP and jobless claims reports.

Companies: Dow components Chevron (CVX, Fortune 500) and Merck (MRK, Fortune 500) reported better-than-expected earnings before the opening bell.

Merck's quarterly profit tripled on strong drug sales, while Chevron reported a 26% jump in quarterly net income, driven by higher energy prices. Shares of both companies closed up roughly 0.5%

Late Thursday, Microsoft reported a 31% surge in quarterly profit, on strong Office and Kinect sales. But not all the news was good, as netbook sales fell 40%. Microsoft's (MSFT, Fortune 500) stock slipped 4% - its worst daily performance since 2009.

Goodyear Tire shares jumped 12% after the company reported better than expected results, mostly because the company was able to raise prices.

Economy: The Commerce Department said Friday that U.S. personal spending rose 0.6% in March, slightly better than the 0.5% expected by economists. Personal incomes rose 0.5% compared with economists' forecast of a rise of 0.4%.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Oil for June delivery closed up 84 cents at $113.71 a barrel.

Gold futures for June delivery settled at a new record high of $1,569.80 an ounce.

Gold prices are benefiting from weakness in the dollar, said David Wyss, chief economist for Standard & Poor's.

"You have to put your money somewhere," he said. "Right now people are afraid because of low interest rates and unsustainable budget deficits."

Bonds: The price on the benchmark 10-year U.S. Treasury slipped, pushing up the yield slightly to 3.32%.

World markets: On Friday, the London Stock Exchange was closed for the royal wedding.

European markets closed mixed. The DAX in Germany added 0.4% and France's CAC 40 closed mostly unchanged, down less than 0.1%.

Asian markets ended the session mixed. The Shanghai Composite rose 0.8%, while the Hang Seng in Hong Kong slipped 0.4%. Japan's Nikkei was closed for holiday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |