Click on chart for more premarket data.

Click on chart for more premarket data.

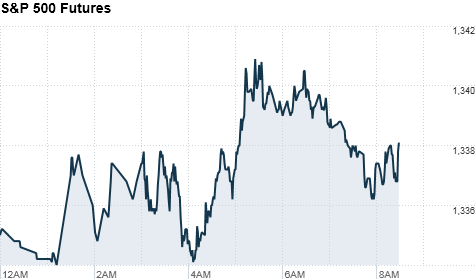

NEW YORK�(CNNMoney) -- Stocks were set to rally at Friday's open, after the government reported that the economy added 244,000 jobs in April, much better than expected.

The unemployment rate ticked higher to 9% from 8.8% but investors were clearly tuned into the top-line number.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up modestly prior to the release but really gained momentum after the release, with futures for all three indexes up nearly 1%. Futures measure current index values against perceived future performance.

Economists were expecting the report to show that employers added only 185,000 jobs in the month and the unemployment rate to remain 8.8%, according to a survey compiled by CNNMoney.

Friday also marks the one-year anniversary of Wall Street's 'flash crash' that sent the Dow industrials plunging nearly 1,000 points in less than 20 minutes.

On Thursday, a sell-off on Wall Street accelerated late in the day, as oil prices plunged and other commodities sharply declined.

Oil, gold, and silver continued to slide Friday.

Just a week ago, silver prices were within spitting distance of breaching $50 an ounce. On Friday, silver futures for July delivery dropped $2.45, or 7%, to $33.80 an ounce.

Gold futures for June delivery fell $2.20 to $1,479.20 an ounce.

Oil for June delivery slipped $2.02, or 2%, to $97.78 a barrel, after plunging 8.6% to close below $100 a barrel Thursday.

After 44 straight increases, the national average price for a gallon of regular unleaded gasoline decreased 0.1 cent Friday, according to AAA. The average price is now $3.984 a gallon.

Companies:After the closing bell Thursday, insurer giant AIG (AIG, Fortune 500) reported a loss from continuing operations of $1.41 per share for the first three months of the year, compared to a profit of $2.16 per share over the same period a year ago.

Shares of AIG were down 1.6% in premarket trade.

World markets: European stocks were mixed in midday trading. Britain's FTSE 100 slid 0.4%, while the DAX in Germany added 0.5% and France's CAC 40 rose 0.3%.

Asian markets ended lower. The Shanghai Composite shaved 0.3%, the Hang Seng in Hong Kong lost 0.4% and Japan's Nikkei tumbled 1.5%.

Currencies: The dollar edged up against the euro, slid against the British pound, and was nearly even against the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury was very slightly lower, pushing the yield up to 3.16%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |