The reason: As a retiree, you'll have to sell assets to live on just when they're dwindling in value. That means there will be a lot less left to grow when the market rebounds.

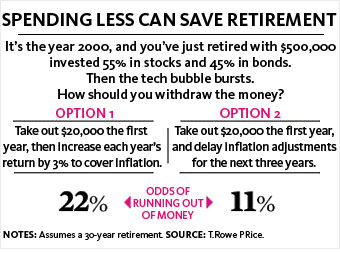

Fortunately, you can keep on track rather painlessly: Spend only a bit less than you were planning to. Say you follow a traditional strategy, taking 4% of your assets out the first year of retirement and boosting the withdrawals by 3% each year for inflation.

If you'd done that starting in 2000, you'd have a 22% chance of running out of money. But if, after the tech bubble burst, you simply hadn't given yourself those inflation raises for the next three years, you'd have cut the odds of your running out of money in half.

NEXT: Check your math