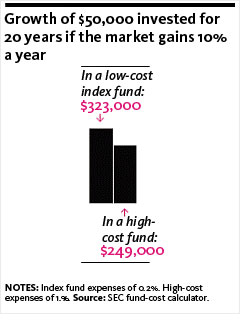

Over time the annual fees of 1% or so that most stock funds carry eat away at your money. Look at how much less you can expect to earn from an equity portfolio that charges 1.5% compared with a broad-based index fund charging just 0.2% a year.

So as you move your money - to harvest tax losses (No. 1), grab up bargains (No. 15 or No. 16) or rebalance your portfolio (No. 17) - choose mutual funds with annual expense ratios that are below their category averages.

You can find such funds using our Fund Screener. It's the one thing guaranteed to improve your long-term returns.

NEXT: Gauge your stomach for risk

Last updated August 16 2008: 4:37 PM ET