If you sell stocks, bonds or funds in taxable accounts for less than you paid, you can subtract the loss from gains elsewhere in your portfolio. If you have more losses than gains, you can write off up to $3,000 of the excess against ordinary income.

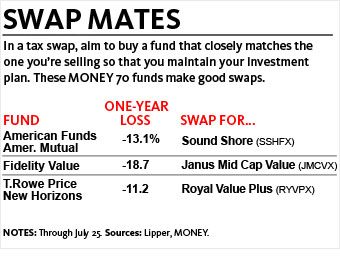

But wait: Hasn't Money Magazine been urging you to stick to your guns and not sell in this market? Good catch! That advice doesn't apply, however, to what's called a tax swap. In it you sell a losing fund and reinvest the proceeds in a similar one. You save a few grand in taxes but stay invested pretty much as you were so you're ready for a rebound.

The goal is to find a close match to the fund you're selling - but one that isn't what the IRS deems "substantially identical." Buy an "identical" investment within 30 days of the sale - before or after - and the IRS disallows the tax break. Thus swapping the Vanguard 500 Index for the Fidelity Spartan 500 Index is out.

However, trading the Vanguard 500 for the Vanguard Total Stock Market Index, which tracks a different index, is perfectly fine - as are the sample pairings above. To find a swap mate, go to our Fund Screener and look for a no-load fund in the same category. (You don't want sales charges to reduce your tax savings.) Maybe you'll find a cheaper fund with a better record than the one you're selling. If so, keep it. If not, you can always buy the old one back in 31 days.

NEXT: Turn off CNBC