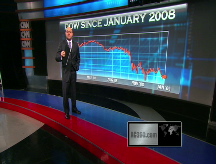

Stocks stage a rally

Wall Street climbs as hopes for the government bailout plan lift financials. Wal-Mart's January sales results help, too.

NEW YORK (CNNMoney.com) -- Stocks rallied Thursday on a mix of optimism about the government's new version of the bank bailout plan and better-than-expected monthly sales from Wal-Mart Stores.

The Dow Jones industrial average (INDU) added 106 points, or 1.3%. The Standard & Poor's 500 (SPX) index added 13 points, or 1.6%. The Nasdaq composite (COMP) added 31 points or 2%.

"The market is trading all over the place based on the day-to-day news," said Haag Sherman, managing director at Salient Partners. "Today it liked the general outline of the bank plan, but I don't think this is a rally that can last."

He said that the economic reports are going to keep getting worse, and that although the market is starting to catch up with the news, stocks have not fully factored in all of the bad news.

What investors have likely already factored in is an abysmal January jobs report. Corporations have been announcing jobs cuts daily and the weekly government claims numbers have been rising.

Due before the market open Friday, employers are expected to have cut 540,000 jobs from their payrolls in January after cutting 524,000 jobs in December.

The unemployment rate, generated by a separate survey, is expected to have risen to 7.5% from 7.2% the previous month.

There is a likelihood that both numbers will be worse than expected, and that the previous two months' figures could be revised lower, said Donald Selkin, chief market strategist at National Securities.

He said that investors will be able to take in stride slightly worse numbers - providing that payroll cuts are under 600,000 and the unemployment rate is under 8%.

News Corp. (NWS, Fortune 500) shares could be active Friday. After the close, the media behemoth reported a quarterly loss of $8.4 billion. Excluding charges, the company reported earnings of 12 cents per share, short of analysts' estimates.

Thursday's market: Stocks slumped in the morning after a spike in jobless claims - bringing them to a 26-year low - exacerbated worries about the duration of the recession. But the market erased losses and turned higher as investors focused on the few retailers that posted better-than-expected January sales.

Anticipation about provisions in the government's new bank bailout plan helped as well.

All week investors have been treating bad - but not as bad as expected - news as a good enough reason to start rallying.

"We just came off the worst year in more than 70 years for the stock market and the worst January in history, so of course people are very pessimistic," Selkin said.

Year-to-date, the Dow is down 8.1%, the S&P 500 is down 6.4% and the Nasdaq composite is down 2%.

"There's such a high level of pessimism in the market that anything good is going to make people feel better," Selkin said. "Today, you have Wal-Mart and some of the rumors about the mark-to-market rule being suspended."

Financials: The Obama administration is expected to announce Monday how it will use the remaining $350 billion of the Treasury's Troubled Asset Relief Program (TARP).

Among the reports surfacing are that the government could temporarily suspend or alter the "mark-to-market" accounting rule. This would enable the government to buy bad assets from banks at below-market rate, but not at fire sale prices.

Among the criticisms of the way the Bush administration handled the first half of the TARP is that the Treasury overpaid for the bad assets it bought. That critique was again brought up at a Senate hearing Thursday by Elizabeth Warren, head of the Congressional Oversight Panel.

Altering the accounting rule, as has been rumored, could help resolve the issue of overpayment. Clearing the bad assets off bank balance sheets, the original goal of the TARP program, would ostensibly help spur lending.

Bank stocks climbed, including American Express (AXP, Fortune 500), Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Goldman Sachs (GS, Fortune 500). Bank of America (BAC, Fortune 500) recovered some ground after falling to a more than 20-year low.

Market breadth was positive. On the New York Stock Exchange, winners topped losers three to two on volume of 1.63 billion shares. On the Nasdaq, advancers topped decliners by almost two to one on volume of 2.57 billion shares.

Economy: The number of Americans filing new claims for unemployment last week rose by 35,000 to 626,000, a more than 26-year high. The figure was worse than what economists were expecting, according to a survey by Briefing.com.

Another report showed that factory orders fell 3.9% in December, after dropping a revised 6.5% in the previous month. Economists thought orders would drop 3.5%.

Retail sales: The nation's chain stores reported another rough month of year-over-year sales as the recession continued to gouge consumer spending. Overall sales are expected to have fallen 2.3%, according to Thomson Reuters estimates, versus a gain of 0.4% a year ago.

However, retail sales have been weak for months and the latest batch provided few surprises. With a few exceptions, most retail stocks rose Monday, even when the companies reported weak sales.

Clothing and luxury retailers were hit especially hard in the month. Abercrombie & Fitch (ANF) said sales fell 20% last month, Nordstrom (JWN, Fortune 500) reported a decline of 11.4% in the month and Pacific Sunwear (PSUN) posted an 11% decline.

However, not all the news was bad. Discounters such as Wal-Mart Stores (WMT, Fortune 500) continued to benefit. Wal-Mart said sales rose 2.1% in January, topping its own forecasts.

Meanwhile, Gap (GPS, Fortune 500) reported a 20% drop in January sales, missing forecasts. But the company also raised its full-year profit forecast, sending shares higher.

Earnings: Late Wednesday, Cisco reported weaker sales and earnings that nonetheless beat estimates. However the company also said that it expects a sales decline of 15% to 20% in the current quarter. Cisco (CSCO, Fortune 500) shares jumped 3%.

Washington: After a narrow party-line approval in the House last week, the roughly $900 billion economic stimulus package is being debated in the Senate this week.

(For a look at how the stimulus plan will help the unemployed, click here.)

Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 2.89% from 2.94% Wednesday. Treasury prices and yields move in opposite directions.

Lending rates were mixed. The 3-month Libor rate held steady at 1.24%, unchanged from Wednesday, according to Bloomberg.com. The overnight Libor rate rose to 0.32% from 0.25% Wednesday. Libor is a bank lending rate.

Other markets: In global trading, Asian and European markets both ended mixed. After four months of cuts, the European Central Bank held interest rates steady at 2%, as had been expected. The Bank of England cut its rate to an all-time low of 1% from 1.5% at the previous meeting.

The dollar rose versus the euro and yen.

U.S. light crude oil for March delivery rose 85 cents to settle at $41.17 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $12 to settle at $914.20 an ounce.

Gasoline prices rose seven-tenths of a cent to a national average of $1.907 a gallon, according to a survey of credit-card swipes released Thursday by motorist group AAA. ![]()