Stocks give up gains after Fed

Wall Street abandons the rally late in the session as investors consider weak banking sector, the central bank's decision to hold rates steady.

NEW YORK (CNNMoney.com) -- Stocks ended mixed Wednesday, giving up bigger gains after the Federal Reserve kept interest rates unchanged and said it will keep them low for an extended period.

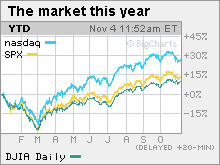

The Dow Jones industrial average (INDU) gained 30 points, or 0.3%. The Dow had gained as much as 156 points in the afternoon, but couldn't sustain those gains through the close.

The S&P 500 (SPX) gained 1 point, or 0.1%, and the Nasdaq composite (COMP) lost 2 points, or 0.1%.

Stocks rose through the early afternoon as investors welcomed a pair of labor market reports that signaled the pace of layoffs is slowing. But markets were volatile in the afternoon, cutting gains after the Fed announcement, recharging the advance in the late afternoon, and then abandoning most of the gains by the close.

Although the market pretty much got what it wanted from the Fed, trading is typically volatile on Fed days, said Michael Sheldon, chief market strategist at RDM Financial Group.

He said that the late-day selloff could be attributed to both a bearish banking call by influential analyst Meredith Whitney -- and the S&P 500's inability to hang on above a key technical level.

"I think investors are getting a little nervous, and that's reflected by the fact that the market has pulled back a bit over the last few weeks," Sheldon said.

Since hitting a 2009 closing high of 1097.91 on Oct. 19, the S&P 500 has lost just short of 5% as of Wednesday's close. That retreat followed a massive rally that saw the broad index gain 63% after bouncing off a 12-year low.

Oil prices spiked past $80 a barrel and gold prices flirted with all-time highs just close to $1,100 an ounce. The dollar slipped versus the euro and strengthened against the yen. Bond prices slipped, boosting the corresponding yields.

After the close, Cisco Systems (CSCO, Fortune 500) reported weaker quarterly earnings and revenue that beat estimates. Chief Executive John Chambers said current-quarter revenue would top estimates and that business conditions had bottomed at least six months ago. Cisco shares gained 4% in extended-hours trading.

Federal Reserve: The central bank opted to hold interest rates steady at historic lows near zero, as expected, following its two-day policy meeting.

In its closely watched statement, the bankers said economic activity is likely to remain weak for some time. As a result, "the Federal Reserve will continue to employ a wide range of tools to promote economic recovery and to preserve price stability."

This provided some reassurance to investors who were concerned about how and when the Fed plans to unwind the billions of dollars in stimulus it has pumped into the economy in the wake of the financial crisis.

"The statement was unsurprising," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. "It was more optimistic, but that was in line with the recent data."

He said that at whatever point the Fed does began preparing to raise rates, it will begin preparing the market well in advance.

Jobs: Two reports Wednesday morning suggested the pace of job losses is slowing, raising hopes that Friday's big monthly report will continue that trend.

Payroll services firm ADP said Wednesday that employers in the private sector cut 203,000 jobs from their payrolls in October after cutting 227,000 in September. A consensus of economists surveyed by Briefing.com expected 198,000 job cuts.

A separate report, from outplacement firm Challenger, Gray & Christmas, showed the number of planned layoffs slowed to 55,679 in October, down 16% from September.

In other economic news, the Institute for Supply Management's reading on the services sector of the economy fell to 50.6 in October from 50.9 in September. Economists thought it would rise to 51.5.

Company news: Time Warner (TWX, Fortune 500), the parent of CNNMoney.com, reported weaker quarterly sales and earnings that topped forecasts.

The company also boosted its full-year 2009 forecast and said that its outlook has improved, although it expects to take a $100 million charge in the quarter as it restructures its Time Inc. division.

Dow component Kraft Foods (KFT, Fortune 500) reported weaker quarterly earnings that topped estimates on weaker revenue that missed estimates. The company also boosted its 2009 earnings forecast and cut its revenue outlook. Shares fell 3%.

Merck (MRK, Fortune 500) rallied after it said it expects annual earnings growth of nearly 10% until 2013.

Comcast (CMCSA, Fortune 500) reported higher quarterly earnings that topped forecasts.

Election: Investors also digested results from Tuesday's elections, including Republican victories in two highly competitive races for governor in both New Jersey and Virginia. CNN exit polls suggest that worries about the economy and growing joblessness led to the victories.

World markets: European and Asian markets ended higher.

Bearish news from European banks dragged on markets around the world Tuesday. But Wednesday's new was more upbeat. Société Générale, France's no. 2 bank, said earnings more than doubled from a year ago.

Currency and commodities: The dollar fell versus the yen and gained against the euro.

U.S. light crude oil for December delivery rose cents 80 cents to settle at $80.40 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery climbed $2.40 to settle at $1,087.30 an ounce and hit an intraday record high of $1,098.50 an ounce in electronic trading.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.49% from 3.47% Tuesday. Treasury prices and yields move in opposite directions. ![]()