Click chart for more premarkets data.

Click chart for more premarkets data.

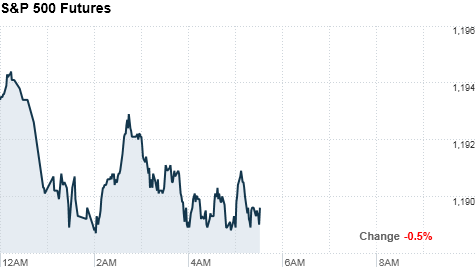

NEW YORK�(CNNMoney.com) -- U.S. stocks were set to open lower Tuesday as investors cast a worried eye at economic developments in Europe.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down ahead of the opening bell. Futures measure current index values against perceived future performance.

Traders on Wall Street have been holding back recently as they await more clarity on the economic outlook for the United States and Europe.

As a result, investors have been taking their cues from daily economic indicators, and have been keeping a close eye on debt auctions in fiscally challenged counties such as Ireland.

Slumping stock futures in the U.S. are reacting to "fiscal problems that continue to rattle investors over in Europe with countries like Ireland and Spain," said Mark Luschini, chief investment strategist for Janney Montgomery Scott. "At the moment, I think the markets are responding to the news that's washing ashore."

Stocks ended mixed Monday, after an early advance on merger news gave way to jitters about the economy.

Companies: Wal-Mart (WMT, Fortune 500), the world's largest retailer, reported earnings per share of 95 cents. Excluding charges, Wal-Mart met forecasts. But the retailer missed on sales, reporting net sales of $101.2 billion versus forecasts of $102.3 billion. Wal-Mart also hiked its outlook for the year. Shares slid a little more than 1% premarket.

Home Depot (HD, Fortune 500) reported third-quarter earnings of 51 cents per share, topping forecasts by three cents. But the home improvement company lowered its full-year sales outlook. Shares of Home Depot were little changed.

General Motors announced an increase in the target price and size of its initial public offering. The target share price for common stock moved to $32 to $33 from its previous estimate of between $26 and $29 per share. As a result, the total size of the offering is now expected to be close to $16 billion.

Clothing retailer Abercrombie & Fitch (ANF) announced third-quarter earnings per share of 56 cents, topping analyst expectations by 5 cents per share. Shares rose in premarket trading.

Economy: A government report on the latest Producer Price Index was delivered before the bell. The report is considered an important reading on the price of goods at the wholesale level. A report on industrial production is also expected Tuesday.

Producer prices rose 0.4% in October, matching the growth rate for the previous two months, but falling short of analyst expectations. The measure had been forecast to have risen 0.8% for October, according to a consensus of economists surveyed by Briefing.com.

Excluding energy prices, the so-called core PPI decreased by 0.6%. It had been expected to be flat at 0.1%.

Economists expect industrial production rose 0.3% in October, after a 0.2% decline in output the month before, according to the consensus estimate from Briefing.com.

World markets: European stocks fell after a report showed consumer prices in the eurozone rose at their fastest pace in two years, hiking inflation fears. Britain's FTSE 100 dropped 1.5%, the DAX in Germany lost 0.8% and France's CAC 40 declined by 1.5%.

Asian markets ended lower. The Shanghai Composite suffered heavy losses, closing down nearly 4% on continued inflation worries. The Hang Seng in Hong Kong edged 1.4% lower, and Japan's Nikkei slid 0.3%.

Currencies and commodities: The dollar strengthened against major currencies, including the Japanese yen, the euro and the British pound.

Oil for December delivery fell $1.18 to $83.68 a barrel.

Gold futures for December delivery fell $10.30 to $1,358.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.90% from 2.91% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |