Search News

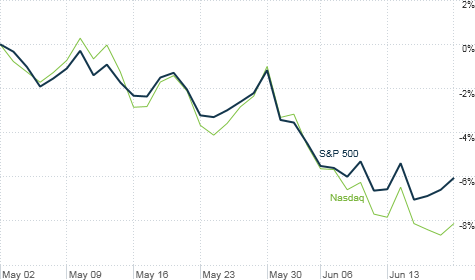

Stocks have pulled back since the beginning of May. Is it the start of a correction? Click the chart for more on the markets.

NEW YORK (CNNMoney) -- Is Greece the 2011 version of Lehman Brothers?

More and more investors are starting to worry that this summer could be a mirror image of the dog days (emphasis on dog) of 2008.

Big banks, particularly in Europe, have massive exposure to Greek debt. And just as Lehman's bankruptcy in September 2008 led to meltdowns at other big financial firms, the worry is that if Greece defaults, it could be the first proverbial domino to fall.

In this case, Europe's other oinkers -- Portugal, Italy, Ireland and Spain -- may play the role of Merrill Lynch, AIG (AIG, Fortune 500), Washington Mutual and Wachovia.

Investors have been pulling out money from U.S. stocks on contagion concerns. According to the most recent figures from mutual fund flow tracker EPFR Global, actively managed stock funds had their biggest week of outflows last week since August.

The market hasn't officially entered correction status (10% below recent highs) just yet. But it's come close.

At one point last Thursday, the S&P 500 was down nearly 8% from the peak point of the year hit on May 2. The market has rebounded since then though and stocks were up Monday.

And some market strategists are holding out hope that Greece circa 2011 is not an uncalled for sequel to something from 2008 (Think "Kung Fu Panda 2.")

"The fears are way overdone. This is not 2008," said Jeffrey Saut, chief investment strategist for Raymond James in St. Petersburg, Fla. "Greece is not going to derail the nascent economy recovery here in the U.S."

Saut argues that the damage from the problems in Europe should be limited to European banks since the balance sheets of U.S. financial firms are in better shape than 2008. Of course, that's not saying much.

And not everyone agrees that the problems in Greece are already baked into the market.

"The worst case scenario in Greece is not priced into stocks. Eventually, there has to be a debt restructuring," said John Toohey, vice president of equity investments with USAA Investment Management in San Antonio.

"That could lead to a banking crisis, which more than anything else creates uncertainty. And that affects everything," Toohey added.

Kevin Flanagan, chief fixed income Strategist at Morgan Stanley Smith Barney in Purchase, NY, said that even if Greece is resolved somewhat soon, (which seems unlikely) investors still won't be able to take their eyes off the periphery of Europe anytime soon. It's just one of the five PIIGS after all.

"The euro crisis will continue to go on. Sometimes it moves to the back burner but it will continue to linger," Flanagan said. "We have to wait and see how Portugal and Ireland play out."

Flanagan said there is some good news though. As long as Europe remains mired in sovereign debt hell, that should bode well for both U.S. Treasuries and the dollar. They could benefit from the so-called flight to quality.

But it's not as if the United States is in great shape either. If quality simply means "slightly less worse," then the greenback and Treasuries may qualify.

However, Toohey said that the combination of euro debt woes and the slowdown in the U.S. economy could lead to an even bigger swoon in the market.

He said that the best investors can hope for in terms of economic growth in the U.S. for the foreseeable future is an annual rate of between 2% and 3%. That's significantly lower than what market bulls are expecting. As such, he thinks stocks could fall another 10% from here.

Saut did not rule out the possibility of a big fat Greek sell-off sometime in the coming months either. A mini Flash Crash if you will.

But he thinks that a violent drop could be healthier than a slow bleed of selling like we've had over the past month or so.

"The market is close to making lows," he said. "The question is whether we get a selling climax or a continued slow grind of selling. If you have a pornographic type plunge in an hour, I'd be inclined to buy it."

So is this 2008: Part 2 or not? It's impossible to say. But it looks like the one thing that you can count on in these increasingly unsettling times is that volatility is back.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: