Search News

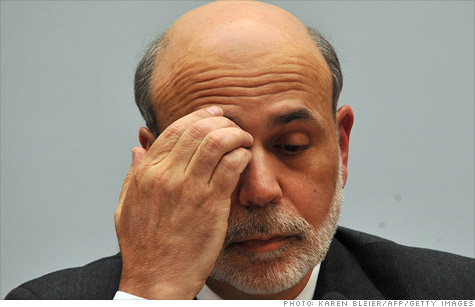

Federal Reserve chairman Ben Bernanke looks how the market feels. Worries are growing about the global economy and the Fed's pledge to keep rates low until 2013 did little to calm investors.

NEW YORK (CNNMoney) -- Is the Federal Reserve waving the white surrender flag? It sure looks that way.

The Fed made the unusual (and unprecedented) move on Tuesday to tell the market in plain English that it intends to keep rates near zero for the next two years!

That is disappointing on many levels. First and foremost, it is a crystal clear sign from Ben Bernanke and other Fed members that they think the economic recovery (if one could still call it that) will remain tepid for a long time.

That is probably one of the reasons that the post-Fed euphoria on Tuesday afternoon on Wall Street quickly gave way to despair again on Wednesday.

This is not good. The Great Recession may have technically ended in June 2009. But for many Americans, this current malaise is just an extension of the problems that first began to surface in 2007. Lost Decade anyone?

Yes, that's a Japan reference. And it's sadly apt. The Fed, by pledging to leave short-term rates "exceptionally low" for what will eventually amount to a four-and-a-half-year stretch, is essentially guaranteeing that long-term bond rates will remain persistently low -- just like in Japan.

The yield on the 10-year Treasury is at about 2.13%. Yields actually briefly touched the all-time low from December 2008 of 2.03% on Tuesday after the Fed announcement before bouncing back.

Would it be any surprise if the 10-year soon had a 1 handle on it like there is for Japan's 10-year bonds? That would be extremely troubling. The time to emulate Japan's economy was in the 1980s. Not now.

It's even more ironic since Bernanke criticized the Bank of Japan in a paper in 1999 while he still was a professor at Princeton. The title? "Japanese Monetary Policy: A Case of Self-Induced Paralysis?"

I have several more bones to pick with the Fed. Why did the central bank feel that it was a good idea to put a specific time frame on when it will raise rates in the first place? Even if it was mid-2012 that would have been silly.

I'm all for transparency. And the Fed under Bernanke is clearly a lot less opaque than it was under Alan Greenspan. But sometimes the Fed can give the markets, to use teen texting parlance, TMI.

The Fed has now effectively boxed itself in regardless of what the economy does over the next few months and year. Sure, it seems impossible now to think that the economy will pick up dramatically anytime soon. But keep in mind that economists, the market and the Fed are often wrong.

Things can change quickly. Nobody saw the Arab Spring revolts coming. Ditto for the Japan earthquake.

In the unlikely event that the economy does begin to improve next year, the Fed won't be able to start raising interest rates without causing another panic because it has promised fickle investors that we'll be at zero until 2013.

I guess the Fed could backtrack and change its mind. Kurt Karl, chief U.S. economist with Swiss Re in New York, points out that the Fed didn't technically rule out rate hikes next year. He said that small increases from zero would still technically keep rates "low."

But the market is clearly interpreting the Fed statement as a sign that it will keep rates on hold. So any interest rate bump could further damage the Fed's credibility in the eyes of investors, consumers and politicians.

Yes, politicians. Try as the Fed might to stay above the political fray, that's impossible for a Washington-based government organization to do.

Think about it. The Fed conveniently picked mid-2013 as its earliest possible start date to tighten? Really? Is it coincidental that by doing so, the Fed avoids getting dragged into the nasty presidential election cycle? Come on.

I applaud Fed regional presidents Charles Plosser of Philly, Richard Fisher of Dallas and Narayana Kocherlakota of Minneapolis for objecting to putting a firm time table on tightening.

The Fed should react when it's necessary -- not when the calendar tells it is okay to do so. (Earth to Barney Frank. This is why Fed presidents, instead of only Fed governors, need to stay on the FOMC. They actually have a backbone!)

Now to be fair to the Fed, it looks like the central bank is also acknowledging that it probably needs to keep rates low because there is a snowball's chance in you know where of any other Washington body doing what's needed to get the economy back on track.

The word "stimulus" is now considered to be more profane than any of the colorful phrases that used to be tossed around on the late, great HBO show "Deadwood."

"While the rest of the government is obviously incapable of providing stimulus, the Fed is showing that it is willing to do so for the long-term," said Dr. Robert Shapiro, chairman of Sonceon, an economic advisory firm in Washington.

Shapiro, who served as Under Secretary of Commerce for Economic Affairs in President Clinton's administration, said the Fed doesn't need to be fighting inflation now. And he's right. To a point.

Low rates are a blessing and a curse. Sure, it's encouraging that investors around the world are still buying U.S. debt (and driving rates down in the process) in spite of Standard and Poor's downgrade on Friday.

But at the same time, extremely low rates are a symptom of stagnation that is often accompanied by a weak currency. It will be harder to call the dollar the world's reserve currency with a straight face if it continues to lose ground.

A chronically weaker dollar risks fueling commodity inflation again like it did earlier this year. And the last thing Americans need right now is yet another round of sticker shock at the gas pump and grocery store.

That could also be a reason why the Fed may be reluctant to start a third round of quantitative easing, a program of bond buying that also helps to keep long-term rates low.

"Will the Fed jump in with QE3? There was commodity inflation with QE2. That is clearly a problem," said Karl.

Yes, it is. Especially when you consider that the Fed seems to be more interested in trying to calm the financial markets with low rates instead of coming up with plans that might actually help "promote effectively the goals of maximum employment and stable prices."

Last I checked, those were still the Fed's only two mandates.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |