Search News

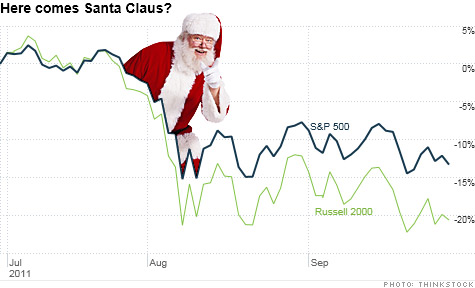

Blue chip stocks got creamed in the third quarter. Small caps fared even worse. With fears about Europe and a sluggish U.S. economy, can stocks rally like they often do at the end of the year?

NEW YORK (CNNMoney) -- "Father Christmas, give us some money!"

That cynical holiday tune by the Kinks is more appropriate than usual this year. A dismal third quarter is about to end for the markets. Investors are in desperate need for one of those typical fourth-quarter surges that often get dubbed a Santa Claus rally.

Will it happen? I hate to be a Grinch. But no Virginia, there probably isn't going to be a Santa Claus rally.

The fourth quarter may not be as horrific as the third quarter. Can we really do worse than the S&P 500 (SPX) falling 12% and small cap stocks plunging more than 20%? (Whoever coined the phrase "sell in May and go away" deserves this year's Nobel Prize for Economics.) But it's unlikely to be good either.

"I find it difficult to be overly bullish right now but I find it hard to be overly bearish either," said Randy Frederick, director of trading and derivatives at Charles Schwab in Austin. "Stocks may stay in a tight range for another four to six weeks at least. We need some resolution to the debt issues in Europe."

Ah yes, Europe. Greece is the birth place of democracy and also of this summer's whiplash-inducing volatility. As long as investors have visions of a Greek default and visits from members of the so-called troika to Athens dancing in their heads, it's hard to imagine how stocks can go much higher.

The odds of Greece avoiding some sort of default (be it orderly, partial or flat-out chaotic) are long at this point. That's why some investors wish the EU, ECB and IMF would stop delaying the inevitable.

"Greece is like a patient on life support. It can go any which way," said David Marcus, manager of the Evermore Global Value Fund (EVGBX) in Summit, N.J. "We may soon get to the point where they pull the plug. But if that happens, at least there is finality."

Marcus believes that Greece should try for a "managed" default scenario in which bondholders agree to take a bigger hair cut on their holdings. That won't be pretty. But at least would be action, as opposed to more talk and rumors.

He added that the PIIGS debt crisis has led to "indiscriminate" selling across the globe and that there are even attractive buying opportunities in Europe.

A top holding in his fund is Grupo Prisa (PRIS), a Spanish media company with a growing presence in Latin America. Marcus said he's also considering investing in German industrial conglomerate Siemens (SI).

"Many companies in Europe are much smarter than their countries. They've streamlined their businesses and have strong balance sheets."

Bill Smead, manager of the Smead Value Fund (SMVLX) in Seattle, also thinks that the market's tough third quarter has created some bargains. He describes the massive pullback in stocks and commodities as the equivalent of an institutional investor temper tantrum.

"Big money investors that get sucked into crowded trades are like spoiled children. Their first reaction is 'If I can't have what I wanted, I don't want anything,'" he said.

But Smead thinks that the worst may be over for stocks. He believes that investors will soon shift their focus from Europe and back to the U.S. and favors consumer companies like Walt Disney (DIS, Fortune 500), McDonald's (MCD, Fortune 500), Starbucks (SBUX, Fortune 500) and outdoor sporting goods retailer Cabela's (CAB).

His argument is that even though consumer confidence is abysmal, that was also the case when the market was bottoming in the spring of 2009. Consumers base their attitudes off of current headlines, and not necessarily accurate projections into the future.

"When the quarter started out ninety days ago, the market decline was all about Europe. That's been heavily discounted by now," Smead said. "And our investing psychology is that you buy U.S. stocks when consumer sentiment is at its lows."

Frederick agreed. He said that many big companies still have healthy balance sheets and are in a position to report solid profits. That's a stark contrast from the last time the markets were this volatile -- the fall of 2008.

"Our markets are ripe for a return back to what's going on domestically. I am hopeful that in a couple of weeks we'll focus on earnings," Frederick said. "That may do our markets some good to focus internally instead of across the pond all the time."

As tempting as it is to be that bullish, I'm still more than a bit worried about where stocks go in the next few months.

Frederick conceded that if Greece defaults, you can't underestimate the damage that will do to the U.S. market. If nothing else, it's likely to cause the dollar to surge against the euro, which would put a severe dent in profits of blue chip multinational companies.

Marcus added that investors have to be patient -- before quickly adding that he realizes how difficult that can be when the markets have been rocky for such an extended stretch. In other words, stocks should rally eventually but Kris Kringle may not be stuffing big returns in investors' stockings.

"When you buy things in the midst of a crisis you are usually well-rewarded. The question is how long down the road," he said. "We're down for the year. I'm aggravated and incredibly frustrated. We just need a modicum of investor confidence."

A modicum would be nice. But I think most investors would settle, to fittingly use a letter of the Greek alphabet, for an iota.

Reader comment of the week. One of the big non-Europe stories this week was tablet mania. But Amazon's unveiling of the Kindle Fire inspired me to tweet the following mash up.

"If Europe was a tablet: Germany = iPad, France = Kindle Fire, Italy, Spain = Galaxy, Ireland = Xoom, Portugal = PlayBook, Greece = TouchPad"

That apparently struck a chord with fellow market/tech nerds. After 30 retweets, my favorite response came from Andy Meek. He compared e-readers to social networks.

"IMO, the Nook=Twitter, the iPad=Facebook, and the Kindle Fire=Google+" he tweeted.

Good one. But might I humbly suggest an addition? Kobo = MySpace.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: