Search News

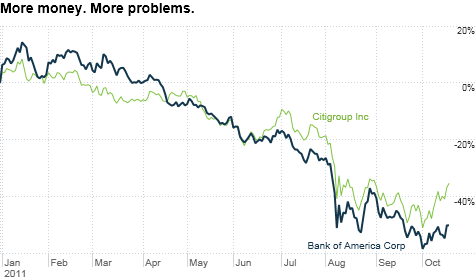

Shares of BofA, Citi and other big banks have rebounded a bit following earnings reports. But the Wall Street bank stocks remain in the dumps due to worries about Europe and other risks.

NEW YORK (CNNMoney) -- Big banks are engaging in a kind of accounting doublespeak that would make George Orwell blush.

In the past week, JPMorgan Chase, Citigroup, Bank of America, Goldman Sachs and Morgan Stanley all reported pre-tax gains from something called debit value adjustments, or DVA.

Here's how it works: Investors are nervous about the health of many top banks, particularly their exposure to Europe. As a result, the spreads on credit default swaps (remember them?) for these banks are widening. That's not a good sign since credit default swaps are essentially insurance policies against insolvency.

Enter the magic of legal accounting. Banks are benefiting from being hated. If they had to buy back debt today, it would be at a discount. They then book the gain as a paper profit.

How much of an impact has this had on the banks? A significant one.

JPMorgan Chase (JPM, Fortune 500) cited a $1.9 billion pre-tax gain in the third quarter. It's overall net profit was $4.4 billion. Citigroup (C, Fortune 500) took a slightly different tack in its report, saying that credit value adjustments, or CVA, lifted its revenue by $1.9 billion in the quarter. (DVA, CVA. Tomato, to-mah-to. Let's call the whole thing off.)

Bank of America (BAC, Fortune 500) reported a $1.7 billion pre-tax gain thanks to DVA. And Morgan Stanley (MS, Fortune 500) said Wednesday that its revenues received a $3.4 billion boost from DVA.

But Goldman Sachs (GS, Fortune 500), the only one of the top investment banks to report a quarterly loss, interestingly did not benefit as much from DVA.

In its quarterly conference call with analysts, CFO David Viniar said that its DVA gains were just $450 million. Viniar explained that Goldman hedges much of its credit default swap exposure.

To be fair to the banks, there is nothing technically wrong with this accounting. In fact, the banks may paradoxically get hurt in the future if Europe fears subside and credit default swap spreads ease. Those big DVA gains will narrow or could even turn into losses.

In its earnings release, JPMorgan Chase CEO Jamie Dimon said that the widening of the bank's credit spreads could "reverse in future periods" and added that they do "not relate to the underlying operations of the company."

But here's the thing. The fact that the banks are able to somewhat ghoulishly profit because other people are betting on their demise just shows how uncertain the markets are right now.

Who in their right mind would really want to make a short-term bet on big banks until it's painstakingly clear what will happen in Europe? A botched bailout of Greece could lead to higher bond yields in Italy and a major bloodbath in French banks. Make no mistake. That would make its way to Wall Street in some form.

Europe is the only thing that matters right now to investors. And as long as rumors rule the day (The EFSF will reportedly be 2 trillion euros! France may get downgraded! Unnamed sources say troika members mulling gyros instead of moussaka for lunch!) it's impossible to know where the overall market is heading, let alone bank stocks.

If anyone tells you differently, they are lying. Andrew Milligan, head of global strategy with Standard Life Investments in Edinburgh, Scotland, said the next few weeks will be crucial. He said there needs to be a credible plan to deal with Europe no later than the next G20 meeting in Cannes in early November.

"Markets could go up 10% from here or down 15% and nobody knows which way it is going to be," he said.

Now this is not to suggest that all banks are screaming to be shorted. One of the problems with the populist uproar against financials is that the arguments against them get too simplistic (profits and bonuses are evil!) and the whole group is unfairly demonized. This happened in the wake of TARP in 2008.

There are plenty of smaller community and regional banks that are getting by with plain vanilla banking -- lending and taking in deposits.

"There is more confusion looking at the earnings of larger banks. There are so many more moving components," said Frank Barkocy, director of research with Mendon Capital Advisors in New York, a firm that invests primarily in financial services firms.

Barkocy said he likes larger regional banks such as PNC (PNC, Fortune 500) as well as smaller banks SCBT (SCBT) in South Carolina, Virginia Commerce Bancorp (VCBI) and City Holding (CHCO) in West Virginia. He said City Holding could benefit from the natural gas drilling boom in the Appalachian region of the U.S., particularly the Marcellus Shale.

These banks may be more boring. Consumer banking may not be as sexy or lucrative as underwriting initial public offerings, advising on mega mergers or making exotic trades tied to currencies and commodities.

But you know what? The smaller banks don't need convoluted constructions like DVA to lift their earnings. You don't need the financial equivalent of CliffsNotes to make heads or tails of their financial results.

And you don't have to worry that they may have some previously buried counterparty risk tied to SocGen's investments in Greek bonds that can come back to haunt you.

In other words, they are relatively safe -- which is a lot more than you can say for the Wall Street banks.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: