Search News

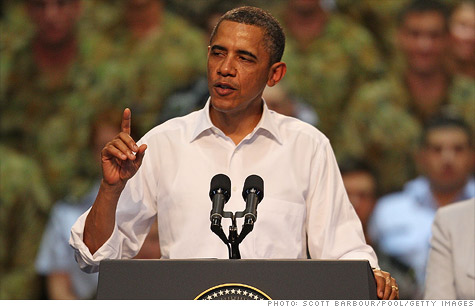

President Obama is expected Tuesday to keep the pressure on Congress to extend the payroll tax cut.

NEW YORK (CNNMoney) -- With the super committee's failure, lawmakers are now facing a year-end legislative challenge that could have an outsized impact on the economy.

At issue: Whether to extend the payroll tax holiday, or let it expire.

Employees normally pay 6.2% on the first $106,800 of their wages into Social Security, but this year they've only been paying 4.2%. That tax break, however, is set to expire Jan. 1. (Read: Debt panel's failure is a red flag)

Failing to extend it would amount to raising taxes during a rough economic patch -- something that President Obama would like to avoid.

Obama is expected to ramp up pressure on Congress Tuesday during a visit to New Hampshire, where he will call on lawmakers to extend the payroll tax holiday.

After all, gross domestic product grew at a rate of 2.0% in the third quarter, and a paltry 1.3% in the second quarter. Unemployment is at 9%, and the housing market remains tied in knots.

But Congress has not moved. The super committee was expected to address the extension in its negotiations, but the group announced Monday it had failed, and the issue remains outstanding.

If lawmakers don't extend the tax break, many Americans will be getting less money in each paycheck starting in January.

A full 121 million families have benefited from the tax break, according to the Center on Budget and Policy Priorities. The increase in take home pay: $934 for the average worker.

If that goes away, growth could suffer.

The theory is this: Without that extra money in their pockets, consumers won't have as much purchasing power, and that will drag down economic growth as consumers spend less.

Economists at Capital Economics expect that consumption growth will suffer "a very sharp slowdown in the first quarter of next year if the payroll tax cut is not extended," according to a research note released Monday.

And Moody's Analytics estimated in August that letting the tax cut expire would reduce growth by as much as 0.5%, and called extending the cut one of the "most straightforward" ways to "reduce some of the coming fiscal restraint."

There are a few possible downsides, Moody's said. For instance, some of the tax break is bound to be saved by consumers, instead of spent, especially for high-income earners. But on net, extending the cut "would provide important support to the soft economy."

Extending the tax cut might not be the easiest sell on Capitol Hill, especially with a price tag of more than $100 billion.

Already, opposition is lining up. Jeff Sessions, the ranking ranking Republican on the Senate Budget Committee, told the Washington Post that the national debt was "a greater threat to us" than the weak economy.

"If the super committee fails, I think there will be a stark realization by every member of the U.S. Senate that we're at the end of the year and these complex challenges have not been dealt with," Sessions told the Post. "It's likely to be a really difficult period." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |