Search News

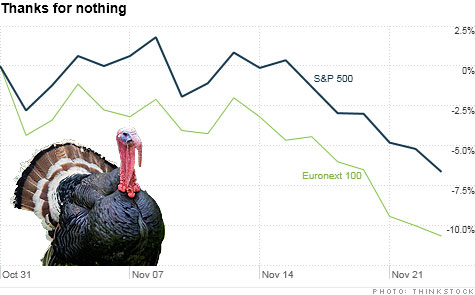

Stocks in the U.S. and Europe have tumbled in November as concerns about debt and deficit problems returned with a vengeance.

NEW YORK (CNNMoney) -- The Federal Reserve is essentially asking big Wall Street banks to estimate how much they will lose in case a plague of locusts descend on Europe and the United States.

Germany suffered from a lack of strong demand for its supposedly safe bunds. And China, one of the few global economies still humming along, is starting to show more signs of strain as well.

Is it any wonder that investors are in a foul (fowl?) mood ahead of Turkey Day? Stocks are getting the stuffing (I have no shame) kicked out of it today. It even led my Twitter follower Alfredo Rodriguez to joke that there was no reason to be thankful "unless you are short Earth."

The market's precipitous slide in November -- the S&P 500 is down nearly 7% so far this month -- has experts wondering if the huge rally in October was just a head fake. A mirage.

Sadly, the problems afflicting the global economy didn't end in October. And investors are being reminded of that now.

In fact, some strategists worry that stocks have more room to fall before the end of the year because investors did get too excited in October. After all, the S&P 500 surged more than 10% that month.

"This market can get uglier in a hurry. My sense is that people are not worrying enough about Europe," said Jack Ablin, chief investment officer with Harris Private Bank in Chicago.

Ablin said it's now looking as if at least one (if not more) eurozone nations will default on its debt. And he said it is unclear just how much of an impact such a default would have on U.S. banks and the U.S. economy.

Investors are selling first and asking questions later. The Fed's new stress tests -- to be completed early next year -- have people nervous about what will happen if the likes of Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Goldman Sachs (GS, Fortune 500), Morgan Stanley (MS, Fortune 500) and Wells Fargo (WFC, Fortune 500) fail and need to raise more capital.

It's also not certain if Europe's woes will put a significant dent in the growth of China, India, Brazil and other emerging markets. But Wednesday's preliminary report about a slowdown in Chinese manufacturing activity is troublesome. That means that investors have more reasons to worry than to be optimistic.

Another big concern? Politics. The bickering in Europe about how to solve the debt crisis doesn't inspire faith among investors. Neither does the failure of U.S. lawmakers to come up with a real plan to tackle America's mounting deficit problems.

The inability of the so-called super committee to reach a deal earlier this week reminded many of the debt ceiling debacle in August that culminated with Standard & Poors stripping the U.S. of a perfect AAA credit rating.

Jeffrey Saut, chief investment strategist for Raymond James Financial in St. Petersburg, Fla., said that based on pure fundamentals and valuations, stocks look like they should be bargains. He argues that the market is as oversold now as it was in early August after the S&P downgrade.

But he cautions that the market may not bounce back until politicians in Europe and the United States come up with viable long-term economic solutions and not just quick fixes.

"The markets should not be doing this. But it is a compilation of dysfunctional government, the total lack of leadership in this country, and the problems in the European debt markets," Saut said. "Somebody needs to step up to the plate in Europe to backstop debt. They can't let Italy fail."

Needless to say, that would be catastrophic -- a real worst-case scenario. But assuming that Europe does finally get its act together, shouldn't stocks finally bounce back?

Kate Warne, chief investment strategist with Edward Jones in St. Louis, thinks so. She argues that investors have been ignoring good earnings in the United States. Deere & Co (DE, Fortune 500)., for example, was the latest well-known firm to post a strong profit and give a decent outlook too. The stock rose 4% Wednesday.

Governments are struggling but companies are still doing well. Investors are focusing entirely on sovereign debt.

Of course, the big wild card is whether the European (and American) debt problems eventually lead to a big profit pullback. That's what the market is betting on now.

And you can't really fault investors for taking the glass is half full approach.

Even Warne conceded there are few catalysts on the horizon to get the market back on track.

"What will it take? Time," she said.

Best of StockTwits: Europe woes and bank stocks unsurprisingly dominated the conversation over on StockTwits.

ivanhoff: Record number of people are naming their turkey "Euro". The World is Running out of Safe heavens.

If the euro is a turkey, does that make the dollar or yen a turducken?

macroQmicro: $TLT U.S. immune to higher rates? Don't think so! German Bond Auction Flops: higher risk >< higher rates $EWG

Exactly. I wrote about how U.S. Treasuries can't stay this low for long yesterday.

Quantum: Stress tests are a confidence tool - do you think they would come out and say Yes it's official Banks are insolvent, NEVER HAPPEN $ES_F

True. No bank is likely to completely fail. But I agree with the next reader about what may be next for bank stocks.

MAYHEM: I think the bank stress tests news out will mean more dilution to the bank stocks. It ain't pretty out there.

And finally, there's a great comment about the biggest financial flightless bird of all: Groupon (GRPN).

fundmyfund: Coupons are not quite the game changing innovation after all $GRPN -but the investment bankers made their money & that's the important thing.

Wall Street may have cashed in. But Groupon looks more and more like social media's Pets.com, doesn't it? Wonder if LivingSocial will ever go public now?

Anyway, The Buzz is off tomorrow and Friday. Happy Thanksgiving to all!

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: