Search News

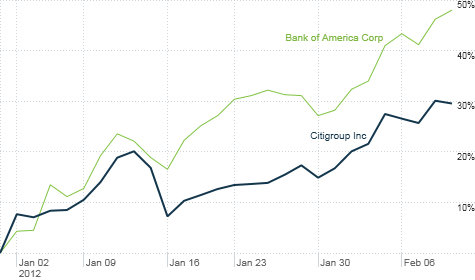

Shares of Bank of America and Citigroup have soared in 2012 as investors bet legal risks are finally behind them and other big banks.

NEW YORK (CNNMoney) -- Five big banks are forking over $26 billion to states and consumers to settle the robosigning foreclosure mess. You'd think that would be bad news for the four publicly traded banks that were part of the deal.

But investors largely shrugged off the news. Bank of America (BAC, Fortune 500) was up slightly Thursday, continuing its 2012 hot streak. Shares of the beaten down lender have surged nearly 50% so far this year.

The other three publicly traded banks -- Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Wells Fargo (WFC, Fortune 500) -- were all trading lower Thursday. However, those three stocks have enjoyed a strong rally this year too. Chase and Wells are each up more than 10% while Citi has gained nearly 30%.

Why the optimism? It's pretty simple. The four big bank stocks are undeniably cheap. Three of them trade below book value, which is what their assets would theoretically be worth if they liquidated. Wells is the exception.

And the four stocks in this group are all valued in a range of about 8 to 11 times 2012 earnings forecasts. That's a discount to the broader market.

But as I've been arguing for some time, the big banks are cheap with good reason. There are numerous legal risks -- mostly tied to the mortgage business -- as well as concerns about European exposure.

Thursday's settlement takes away one legal headache.

"This removes one cloud that has been overhanging the bank stocks. We at least now know what the cost of the settlement is. You have to view that as a positive," said Frank Barkocy, director of research with Mendon Capital Advisors, an investment firm that focuses on financial stocks.

It doesn't hurt that Greece finally reached a new austerity deal Thursday either.

"Hopefully we are getting closer and closer to the point where the bank stocks will trade on their fundamentals and not get burned by concerns about lawsuits and Europe," said Barkocy, whose firm owns stakes in all four banks involved in the settlement. (Privately held Ally Financial is the fifth lender in the deal.)

Turning back to the foreclosure settlement, $26 billion sounds like a lot. But it's split up among five banks. And the four publicly traded ones are all Wall Street behemoths that have been adding to their reserves because they knew a deal was in the works. So this settlement is unlikely to, uh, break the banks.

"There should be no material impact to earnings on any of the large banks. The size of the settlement is in line with forecasts and with the amounts that the banks have already reserved," said Anthony Polini, an analyst with Raymond James in New York.

That makes sense. The major banks are trading at unusually low levels. The financial effect of the settlement should be minimal. The banks have done an admirable job of shoring up their capital bases since the 2008 credit crisis. And if the economy continues to improve, so should the quality of the loans on their books.

Yet I am still hesitant to declare that the worst is over for the banks and that their stocks are all screaming bargains.

Polini conceded that the banks, particularly BofA, are probably due for a bit of a pullback after such a strong beginning to 2012. It may be a case of taking two steps back after five steps forward.

The huge rally for the banks is also reminiscent to what happened with tobacco stocks prior to a major industry settlement with state attorneys general in 1998.

Keefe, Bruyette & Woods analyst Frederick Cannon noted in a report Thursday that tobacco stocks outperformed the broader market in the six months leading up to the settlement and then lagged in the two months after the deal was announced.

The same thing may happen with the banks, a classic case of buying the rumor and selling the news. However, Cannon was quick to point out that a major pullback wasn't expected since earnings estimates for banks are unlikely to get cut as drastically as tobacco earnings forecasts were in the late 1990s.

Finally, there's also this nagging feeling that the banks are trading at cheap valuations because they deserve it. The foreclosure settlement isn't the end of the legal concerns.

Some of the banks still face lawsuits from investors over mortgage bond pools gone bad. And who's to say that the SEC or other regulatory agencies at the federal and state levels aren't planning other legal action related to the sins of the housing bubble? It's not like robosigning was the only thing the banks did that may be considered suspect.

Yes, it's notable that there were several knock-on settlements tied to the state foreclosure deal Thursday. The Fed and OCC also fined the five banks involved in the state deal.

The United States Attorney for the Eastern District of New York also announced a $1 billion settlement with BofA related to the bank's Countrywide Mortgage unit.

But in the era of Dodd-Frank, banks are once again highly regulated and highly scrutinized. That probably means the days of tech-stock like earnings growth are gone.

"I would not want be a banker today and I would not want to own the bank stocks. There are areas of the market that are safer to go into right now," said David White, president of David B. White Financial, an advisory firm in Bloomfield Hills, Mich. "You still don't know what the government is going to do."

Best of StockTwits: Groupon (GRPN) doesn't take itself too seriously. And after its first earnings, uh, I mean loss, report, investors aren't either. Shares plunged 13% Thursday.

PeterBoKiaer: $GRPN Look at Current Liabilities rise by $600m! Do they pay the merchants? How long can they postpone payments?

ToddSullivan: Does anyone know a merchant who likes $GRPN? I know 4 who have tried it "one and done" they all say

wsmco: @ToddSullivan saw study cpl days ago that said half of merchants say never again with $GRPN.

That is not good. I'm not sure if it's competition from LivingSocial that's hurting Groupon or if this whole Internet coupon thing is just a ridiculous fad. Either way, you have to wonder if Groupon has a viable long-term business model.

techinsidr: The question is... when will $GRPN need to sell more shares? Still operating at a loss, huge fixed costs, and only $1.1B cash

That's always a risk for a newly public company. When you only sell a small portion of your stock, you may eventually need to sell more ... and hurt the value of your current shareholders in the process.

Groupon still is valued at more than $13 billion. But with each passing day, it seems like maybe spurning the reported Google (GOOG, Fortune 500) takeover offer of $6 billion might not have been the best idea.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: