Search News

NEW YORK (CNNMoney.com) -- The Dow closed below 10,000 Monday for the first time in three months, with financial shares leading the way, as worries about the U.S. economy and European debt weighed on investor sentiment.

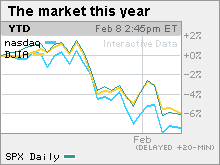

The Dow Jones industrial average (INDU) tumbled 104 points, or 1%, ending at 9,908.39. The last time the Dow finished below 10,000 was Nov. 4, when it closed at 9802.14.

The S&P 500 index (SPX) ended just below break-even. The Nasdaq composite (COMP) shed 15 points, or 0.7%. Neither closed at notable lows.

Since peaking at a rally high on Jan. 19, the Dow has lost 7.6%, the S&P 500 has lost 7.3% and the Nasdaq has lost 8.4%.

"I think you're seeing a concern about how real this economic recovery is," said Kevin Mahn, managing director at Hennion & Walsh. "The sovereign debt issue is the macro concern, but near term, it's all about the economy."

The major indexes have been on a decline for four weeks in a row. The optimism that propelled a 10-month rally off 12-year lows from last March has been replaced by cautiousness. Bets that an economic recovery was gaining momentum -- combined with trillions in fiscal and monetary stimulus -- fed the 2009 rally.

But so far in 2010, markets have been choppy and weak as investors wait for evidence that the still-germinating recovery is really taking hold, particularly amid the hard-hit labor market and housing industry.

"Investors may have priced in a tepid recovery in terms of their strategies, but they haven't priced in sovereign debt issues," said Larry Glazer, managing director at Mayflower Advisors. "That factor, plus companies reporting decent earnings but seeing no response, is having an impact right now."

In January, worries about China curbing bank lending and the White House limiting trading at big banks raised fears about tighter lending standards and the credit markets.

Stocks tumbled toward the end of last week on fears that Greece might default on its debt, which could trigger defaults in other European nations, including Portugal, Ireland, Italy and Spain.

Shares ended little changed Friday and traded in mixed territory through most of Monday, suggesting that the selling was abating and that the knee-jerk reaction had passed.

Helping to take the edge off Monday's declines was a rally in commodity prices and energy and metal stocks as the dollar lost some steam.

Last week, debt concerns battered the euro, propelling the dollar and dragging on dollar-traded commodities. A wish to dump riskier assets including U.S. stocks also added to the selling.

Commodities and the dollar: The U.S. dollar slipped versus the euro after rising to a more than six-month high versus the European currency last week. The dollar strengthened versus the Japanese yen.

Over the weekend, finance ministers from the Group of Seven largest industrialized nations pledged to keep providing liquidity to sustain a recovery. But the issue of Greece's potential default was not specifically addressed.

Commodity prices rallied, with COMEX gold for April delivery rising $13.40 to settle at $1,066.20 an ounce.

U.S. light crude oil for March delivery rose 70 cents to settle at $71.89 a barrel on the New York Mercantile Exchange.

On the move: A number of tech stocks gained, including Hewlett-Packard (HPQ, Fortune 500), Intel (INTC, Fortune 500), Google (GOOG, Fortune 500) and Cisco Systems (CSCO, Fortune 500).

Home Depot (HD, Fortune 500) gained after Morgan Stanley reportedly upgraded the Dow component to "overweight" from "equal-weight," saying it will benefit from a recovering housing market.

But a variety of financial shares fell, dragging on the market. Bank of America (BAC, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Goldman Sachs (GS, Fortune 500) and Wells Fargo (WFC, Fortune 500) were among the big losers.

Market breadth was negative. On the New York Stock Exchange, losers topped winners by three to two on volume of 1.09 billion shares. On the Nasdaq, decliners beat advancers two to one on volume of 2.06 billion shares.

Corporate news: Former Merrill Lynch CEO John Thain will run struggling small business lender CIT Group (CIT, Fortune 500), the company said over the weekend. Thain ran Merrill until it was sold to Bank of America in September 2008, at the height of the financial crisis.

CIT emerged from bankruptcy in December. Shares gained 2% Monday morning.

Toyota Motor (TM), reeling from the recall of more than 8 million vehicles due to brake problems, told its dealers it is close to announcing a solution to the problems with the Prius hybrid Sedan.

Quarterly results: A few big corporations are due to report results this week, including Dow components Coca-Cola (KO, Fortune 500) and Walt Disney (DIS, Fortune 500) on Tuesday and Sprint Nextel (S, Fortune 500) on Wednesday.

Coke is expected to have earned 66 cents per share up from 64 cents a year ago, according to a consensus of economists surveyed by earnings tracker Thomson Reuters. Disney is expected to have earned 39 cents per share, down from 41 a year ago. Sprint Nextel is expected to have lost 19 cents per share after earning 24 cents per share a year ago.

With 320 companies, or 64% of the S&P 500, having reported results, earnings are on track to have risen 207% versus a year ago and revenues to have gained 8%. But the big jump year-over-year is partly due to easy comparisons to a tough fourth-quarter of 2008.

Financial companies in particular are driving the gains. Stripping out financials leaves earnings growth at 16% and revenue growth at 3%.

Results have largely been positive, with 74% of companies beating earnings forecasts and 70% beating revenue forecasts.

World markets: European markets ended higher, with the London FTSE gaining 0.6%. Asian markets ended lower Monday.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.59% from 3.61% late Friday. Treasury prices and yields move in opposite directions. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |