Search News

NEW YORK (CNNMoney.com) -- Stocks struggled Wednesday as investors weighed the Greek debt situation, a strong dollar and Fed chairman Ben Bernanke's plan for eventually withdrawing some of the trillions of dollars used to bolster the nation's financial system.

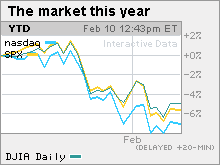

The Dow Jones industrial average (INDU) lost 20 points, or 0.2%. The S&P 500 index (SPX) lost 2 points, or 0.2% and the Nasdaq composite (COMP) lost 3 points, or 0.1%.

Stocks rallied Tuesday as growing bets that the European Union will rescue Greece from its debt problems reassured investors after a four-week selloff. But stocks were choppy Wednesday on concerns that Greece is just the first of many countries that is feeling the pressure of a growing deficit.

Stocks also remain vulnerable to a retreat in the aftermath of 2009's big rally, in which the S&P 500 gained 23%. In the last nine months of 2009, it gained 65%, bouncing off 12-year lows hit in March.

"Greece's issues will get addressed, but I wouldn't be surprised to see a bigger market pullback in the weeks ahead anyway," said Tim McCandless, senior equity analyst at Bel Air Investment Advisors.

However, he said that a larger retreat would probably be met with buyers stepping in at lower levels. Since hitting a rally high on Jan. 19, the S&P 500 is down almost 7%, as of Wednesday's close.

Bernanke's comments on the Fed's plans to wind down its extraordinary measures to bolster lending and the strengthening of the dollar versus the euro were also in play Wednesday.

Bank shares bounced up after several down sessions, countering some of the broader weakness in the market. The KBW Bank (BKX) index gained 1%.

Thursday brings reports on January retail sales, December business inventories and weekly jobless claims.

Bernanke: The Federal Reserve chairman said that while the U.S. economy continues to require the support of emergency programs the Fed enacted at the height of the financial crisis, "at some point the Federal Reserve will need to tighten financial conditions."

He said that the Fed will pull cash from the system before it lifts interest rates, and that its decision to boost the emergency "discount" rate is not the same as a shift in policy. The prepared testimony was meant to be delivered at a House Financial Services Committee hearing that was postponed due to snow.

Debt crisis: Reports late Wednesday said France and Germany may present a rescue plan for Greece at Thursday's meeting of euro zone countries. Meanwhile, Greece has vowed to press forward with cutbacks, despite an ongoing worker strike.

Although Greece's impact is small, the threat of a default there has intensified worries about other debt-challenged European countries, including Spain, Portugal, Ireland and Italy. A crisis overseas would set back the still-fragile global economic recovery and hurt U.S. financial institutions. Investors are also keeping an eye on the growing U.S. budget deficit.

"Even if the EU comes in and stabilizes the debt issue in Greece, my concern is that we still have so much debt around the globe that hasn't been addressed," said Dean Barber, president at Barber Financial Group.

The debt crisis has sparked something of a flight from risk over the last few weeks, with investors choosing government bonds and the dollar over stocks. Investors have fled the euro in favor of the greenback and have sold dollar-traded commodities, commodity stocks and a broad swath of securities in other sectors.

The Dow, S&P 500 and Nasdaq have all declined the past four weeks, despite improved quarterly earnings and revenues, and some positive signs in the economic reports.

Despite Tuesday's rally, the market is likely to stay a "choppy mess" for a while, Barber said.

Economy: The December trade gap widened to $40.2 billion in December from a revised $36.4 billion in November, the government reported Wednesday morning. Economists surveyed by Briefing.com thought it would narrow to $35.8 billion. The widening reflected a pick-up in imports amid the recovering economy.

Walt Disney: The media behemoth reported higher-than-expected quarterly earnings and revenue in a report released after the close of trading Tuesday. Disney (DIS, Fortune 500) shares rose 0.6%.

World markets: European markets mostly ended higher, while Asian markets ended with strong gains.

The dollar and commodities: The U.S. dollar rallied versus the euro and the Japanese yen.

U.S. light crude oil for March delivery rose 77 cents to settle at $74.52 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell 90 cents to settle at $1,076.30.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.68% from 3.64% late Tuesday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers narrowly edged winners on volume of 1 billion shares. On the Nasdaq, decliners beat advancers on volume of 2.04 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |