NEW�YORK�(CNNMoney.com) -- Stocks ended little changed Friday as investors showed caution after a surprise drop in existing home sales, a surprise rise in GDP growth and AIG's worse-than-expected quarterly decline.

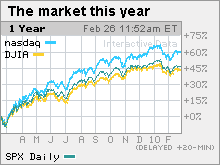

The Dow Jones industrial average (INDU) gained about 4 points, or less than 0.1%. The S&P 500 index (SPX) added less than 2 points, or 0.1% and the Nasdaq composite (COMP) gained 4 points or 0.2%.

The major indexes ended lower for the week, breaking a two-week up streak.

Stocks seesawed through the morning as investors considered the economic news at the end of a tough week on Wall Street.

Stocks fell this week following a steady stream of worse-than-expected economic reports. Readings on housing, jobless claims, durable goods orders and consumer confidence have all disappointed this week.

Meanwhile, concerns about Greece's debt crisis resurfaced this week after having been tamped down for the last few weeks. Such concerns were soothed a bit Friday after Greece's prime minister said the country would take action to get control of its finances.

"There are so many crosswinds right now and they've really gotten everybody in a bit of a funk," said Tommy Williams, founder and president at Williams Financial Advisors.

"It's interesting that we've had one of the strongest quarterly earnings periods in years, but no one's impressed," he said. "I think if we don't see some improvement in the economic indicators, stocks are going to keep moving sideways."

AIG: The financial services behemoth reported a $9 billion quarterly loss Friday, partly because of the costs connected to selling off big stakes in its insurance businesses to pay back some of the debt it owes taxpayers.

The loss was narrower than a year earlier, but bigger than what analysts surveyed by Thomson Reuters expected. AIG (AIG, Fortune 500) shares fell 10%.

Housing: Existing home sales for January fell to a 5.05 million unit annual rate from a revised 5.44 million unit rate in December, according to a National Association of Realtors report released in the morning.

Sales were expected to rise to a 5.5 million unit rate, according to a consensus of economists surveyed by Briefing.com.

The report followed a weaker-than-expected new home sales report from the government, released earlier in the week. Both reports reflected the impact of the homebuyer tax rebates, which were initially expected to end Nov. 30 and then got extended. The perceived end of the rebates jacked up sales in November, taking away some sales from December and January.

Looking forward, economists expect existing home sales to pick up, particularly as prices stay low.

GDP: Fourth-quarter gross domestic product growth (GDP) grew at a 5.9% annual rate, versus the initially reported rate of 5.7%. Economists surveyed by Briefing.com thought GDP would hold steady at 5.7%. GDP grew 2.2% in the third quarter.

Economy: In a busy day for economic news, the University of Michigan's consumer sentiment index was also released. Sentiment dipped to 73.6 in February from 73.7 in January, versus forecasts for a rise to 73.9.

Another report, the Chicago purchasing managers' index on regional manufacturing, rose to 62.6 in February from 61.5 in the previous month, indicating further expansion in the sector. Economists thought the index would fall to 59.7.

World Markets: In overseas trading, European markets rallied, with the London FTSE rising 1.5%, the French CAC 40 rising 1.9% and the German DAX rising 1.2%. Asian markets ended higher.

The dollar and commodities: The dollar fell versus the euro and the yen.

The dollar's weakness gave a lift to dollar-traded commodities, including oil and gold.

U.S. light crude oil for April delivery settled up $1.49 to $79.66 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery gained $10.40 to settle at $1,118.90 per ounce.

Bonds: Treasury prices rallied, lowering the yield on the the 10-year note to 3.54% from 3.59%. Treasury prices and yields move in opposite directions. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |