Search News

Better-than-expected earnings from 3M, Caterpillar and UPS helped lift stocks Thursday.

Better-than-expected earnings from 3M, Caterpillar and UPS helped lift stocks Thursday.

NEW YORK (CNNMoney.com) -- Stocks rallied Thursday after better-than-expected earnings and forecasts from 3M, Caterpillar, AT&T and UPS helped reassure investors about the pace of the economic recovery.

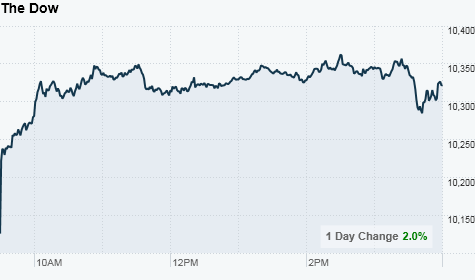

The Dow Jones industrial average (INDU) rose 202 points, or 2%. The S&P 500 (SPX) index jumped 24 points, or 2.3%. The Nasdaq (COMP) composite gained 58 points, or 2.7%.

Stocks slumped Wednesday after Federal Reserve Chairman Ben Bernanke told Congress the outlook for the economy was "unusually uncertain," adding to worries about the pace of the recovery.

But the tone was positive Thursday, on the back of improved earnings, better-than-expected housing market news and a surge in European markets.

After the close, Dow component Microsoft (MSFT, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strong sales of its Windows 7 and a better personal computer market than in recent months. Shares were barely changed after the close.

Also after the close, Dow component American Express (AXP, Fortune 500) reported higher quarterly sales and earnings that topped expectations. But AmEx's CEO said the company remains cautious about the economic outlook and shares dipped 1% in after-hours trading.

Quarterly results: Dow component Caterpillar (CAT, Fortune 500) reported higher quarterly sales and earnings that topped estimates due to better sales of gear for the mining, infrastructure and energy industries. Caterpillar also boosted its 2010 profit forecast. Shares gained 1.7%.

Fellow Dow component 3M (MMM, Fortune 500) reported higher quarterly sales and earnings and said that full-year 2010 profit will exceed its earlier targets, thanks to strong demand in both the United States and abroad. The company is seen as a good proxy for the economy due to the breadth of its business, which includes everything from Scotch tape to films for flat-screen TVs. Shares gained 3%.

UPS (UPS, Fortune 500) reported higher quarterly sales and earnings that topped estimates and said that 2010 earnings will surpass its earlier forecasts. The delivery company cited an increase in package revenue in both the United States and abroad. Shares gained 6%. UPS is often seen as an economic bellwether due to the nature of its business.

Dow component AT&T (T, Fortune 500) reported higher quarterly earnings that topped estimates and higher revenue that was shy of estimates. The company also lifted its 2010 forecast, citing cost cutting and a surge in wireless business, thanks to its exclusive iPhone deal with Apple. Shares gained 2.4%.

Late Wednesday, eBay (EBAY, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strength at its PayPal only payments unit. The online auctioneer also lowered the high end of its full-year 2010 profit forecast, citing the impact of the weaker euro. Shares gained 3.8% Thursday.

Housing: Sales of existing home sales fell 5.1% in June from May levels, according to a report from the National Association of Realtors released Thursday. But the drop was smaller than expected. Sales rose nearly 10% from a year earlier.

Jobs: The House voted to extend jobless claims benefits until November, ending a seven-week old debate between lawmakers that saw federal benefits for the long-term unemployed run out. President Obama is expected to sign the extension shortly.

Earlier, the Department of Labor reported that the number of Americans filing new claims for unemployment rose to 464,000 last week from a two-year low of 427,000 in the prior week. Economists surveyed by Briefing.com thought claims would rise to 445,000.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4,487,000 from 4,710,000 in the previous week. Economists surveyed by Briefing.com expected 4,600,000.

Deals: General Motors said it will buy auto financing firm AmeriCredit (ACP) in a $3.5 billion all-cash deal. The deal gives GM a lending unit after selling its majority stake in GMAC in 2006. The deal was also seen as a key step as GM prepares its initial public offering for later this year, after the government restructured it in bankruptcy. AmeriCredit shares jumped 23%.

Dell: Computer maker Dell (DELL, Fortune 500) agreed to pay $100 million to settle fraud charges with the Securities and Exchange Commission. Chairman Michael Dell and former CEO Kevin Rollins will pay $4 million each. Dell shares finished 2.5% higher.

Leading indicators: The index of leading economic indicators fell 0.2% in June, the Conference Board reported, after rising 0.5% in May. Economists expected the index to have fallen 0.4%.

World markets: European markets rose, with Britain's FTSE 100 up 1.9%, Germany's DAX up 2.5% and France's CAC 40 up 3%.

Asian markets ended mixed. Japan's Nikkei fell 0.6%, while Hong Kong's Hang Seng gained 1.1% and the Shanghai Composite gained 0.3%.

Currencies: The euro gained versus the dollar. The dollar rose versus the Japanese yen.

Commodities: U.S. light crude oil for September delivery rose $2.46 to $79.02 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery rose $2.80 to $1,194.60 an ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 2.93% from 2.89% late Wednesday. Debt prices and yields move in opposite directions.

Market breadth: Breadth was positive. On the New York Stock Exchange, winners beat losers by over six to one on volume of 1.18 billion shares. On the Nasdaq, advancers beat decliners by five to one on volume of 2.28 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |